East China Engineering Science and Technology Co., Ltd. (SZSE:002140) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

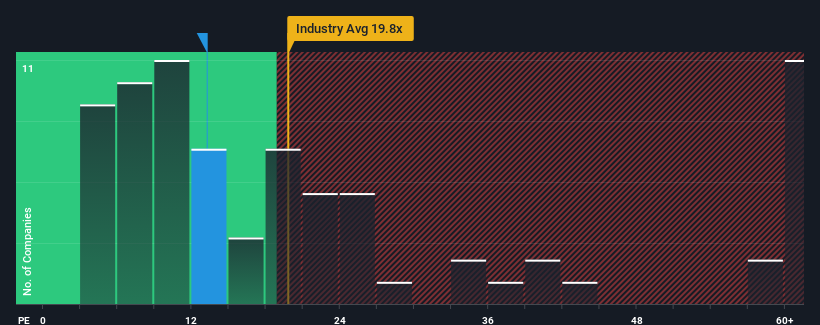

Since its price has dipped substantially, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 27x, you may consider East China Engineering Science and Technology as an attractive investment with its 13.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for East China Engineering Science and Technology as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is East China Engineering Science and Technology's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as East China Engineering Science and Technology's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 4.5% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 12% during the coming year according to the sole analyst following the company. With the market predicted to deliver 41% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that East China Engineering Science and Technology's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The softening of East China Engineering Science and Technology's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that East China Engineering Science and Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for East China Engineering Science and Technology that you should be aware of.

If these risks are making you reconsider your opinion on East China Engineering Science and Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.