Goldlok Holdings(Guangdong) Co.,Ltd. (SZSE:002348) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

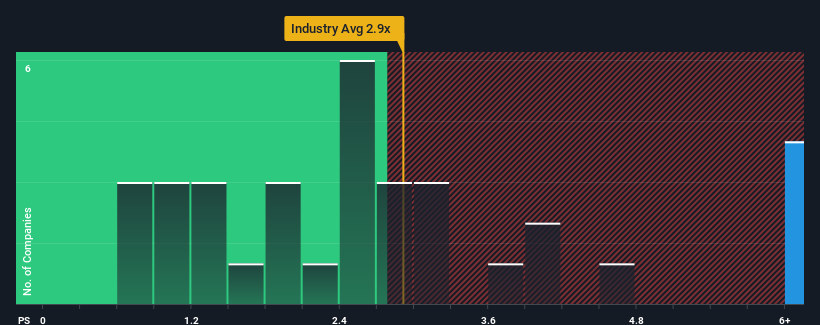

Although its price has dipped substantially, you could still be forgiven for thinking Goldlok Holdings(Guangdong)Ltd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.1x, considering almost half the companies in China's Leisure industry have P/S ratios below 2.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Goldlok Holdings(Guangdong)Ltd Has Been Performing

As an illustration, revenue has deteriorated at Goldlok Holdings(Guangdong)Ltd over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Goldlok Holdings(Guangdong)Ltd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Goldlok Holdings(Guangdong)Ltd?

In order to justify its P/S ratio, Goldlok Holdings(Guangdong)Ltd would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. This means it has also seen a slide in revenue over the longer-term as revenue is down 45% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 22% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Goldlok Holdings(Guangdong)Ltd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Even after such a strong price drop, Goldlok Holdings(Guangdong)Ltd's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Goldlok Holdings(Guangdong)Ltd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Goldlok Holdings(Guangdong)Ltd that you should be aware of.

If you're unsure about the strength of Goldlok Holdings(Guangdong)Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.