Zhejiang Renzhi Co., Ltd. (SZSE:002629) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

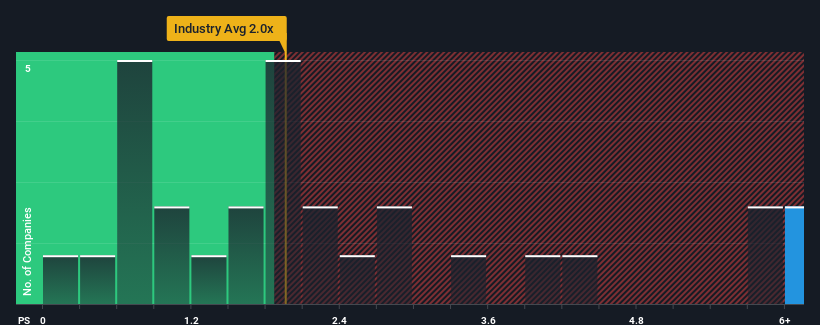

Even after such a large drop in price, you could still be forgiven for thinking Zhejiang Renzhi is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.5x, considering almost half the companies in China's Energy Services industry have P/S ratios below 2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Zhejiang Renzhi Performed Recently?

The revenue growth achieved at Zhejiang Renzhi over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhejiang Renzhi's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Zhejiang Renzhi?

In order to justify its P/S ratio, Zhejiang Renzhi would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. Pleasingly, revenue has also lifted 134% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 18% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Zhejiang Renzhi's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Even after such a strong price drop, Zhejiang Renzhi's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Zhejiang Renzhi revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Zhejiang Renzhi that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.