The Glory Flame Holdings Limited (HKG:8059) share price has fared very poorly over the last month, falling by a substantial 35%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

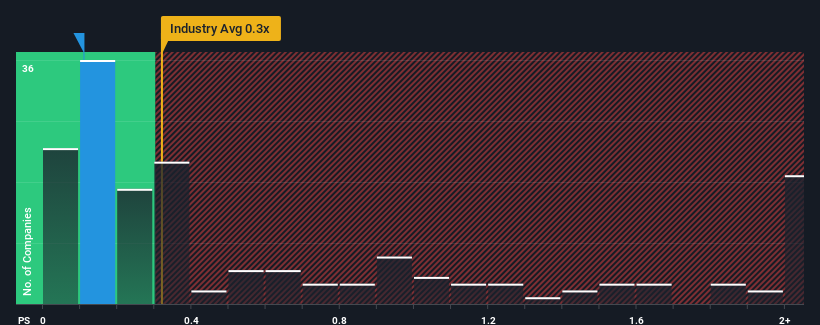

Even after such a large drop in price, there still wouldn't be many who think Glory Flame Holdings' price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Hong Kong's Construction industry is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Glory Flame Holdings' P/S Mean For Shareholders?

The revenue growth achieved at Glory Flame Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Glory Flame Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Glory Flame Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Glory Flame Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Glory Flame Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

In light of this, it's curious that Glory Flame Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Glory Flame Holdings' P/S

With its share price dropping off a cliff, the P/S for Glory Flame Holdings looks to be in line with the rest of the Construction industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Glory Flame Holdings revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Glory Flame Holdings, and understanding them should be part of your investment process.

If you're unsure about the strength of Glory Flame Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.