The Yibin Paper Industry Co., Ltd. (SHSE:600793) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

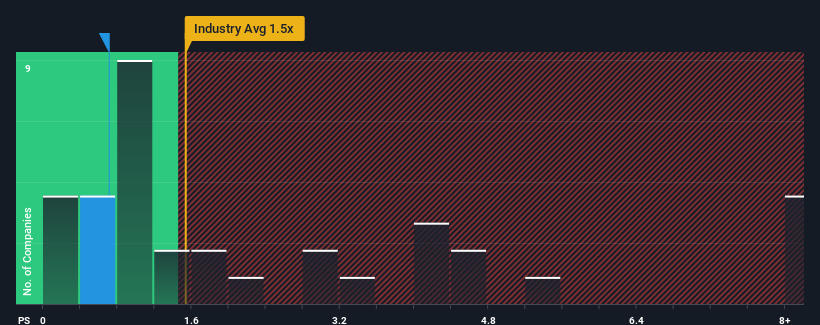

After such a large drop in price, Yibin Paper Industry's price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Forestry industry in China, where around half of the companies have P/S ratios above 1.5x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Yibin Paper Industry Performed Recently?

For example, consider that Yibin Paper Industry's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Yibin Paper Industry, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Yibin Paper Industry's Revenue Growth Trending?

In order to justify its P/S ratio, Yibin Paper Industry would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 47% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Yibin Paper Industry's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does Yibin Paper Industry's P/S Mean For Investors?

Yibin Paper Industry's recently weak share price has pulled its P/S back below other Forestry companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Yibin Paper Industry currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 2 warning signs for Yibin Paper Industry that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.