Zhongshi Minan Holdings Limited (HKG:8283) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

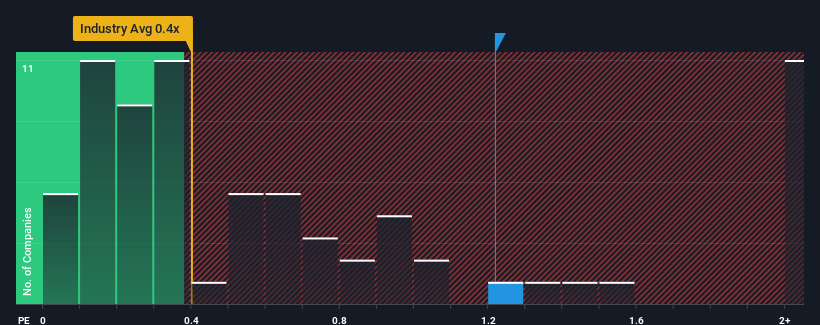

Although its price has dipped substantially, you could still be forgiven for thinking Zhongshi Minan Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.2x, considering almost half the companies in Hong Kong's Commercial Services industry have P/S ratios below 0.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Zhongshi Minan Holdings' Recent Performance Look Like?

Revenue has risen firmly for Zhongshi Minan Holdings recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhongshi Minan Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Zhongshi Minan Holdings?

Zhongshi Minan Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.1%. Revenue has also lifted 15% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 6.7% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Zhongshi Minan Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What Does Zhongshi Minan Holdings' P/S Mean For Investors?

There's still some elevation in Zhongshi Minan Holdings' P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Zhongshi Minan Holdings has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 3 warning signs for Zhongshi Minan Holdings (1 is concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Zhongshi Minan Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.