Xuzhou Handler Special Vehicle Co., Ltd (SZSE:300201) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 15%.

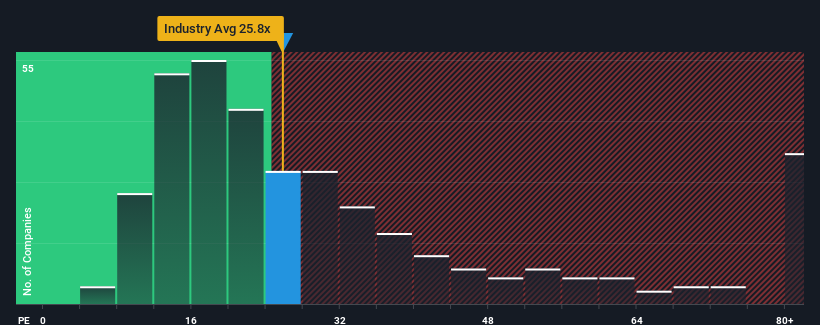

In spite of the heavy fall in price, there still wouldn't be many who think Xuzhou Handler Special Vehicle's price-to-earnings (or "P/E") ratio of 25.8x is worth a mention when the median P/E in China is similar at about 28x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Xuzhou Handler Special Vehicle as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Xuzhou Handler Special Vehicle's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.0%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 90% over the next year. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we find it interesting that Xuzhou Handler Special Vehicle is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Following Xuzhou Handler Special Vehicle's share price tumble, its P/E is now hanging on to the median market P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Xuzhou Handler Special Vehicle currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Xuzhou Handler Special Vehicle with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.