To the annoyance of some shareholders, Richinfo Technology Co., Ltd. (SZSE:300634) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

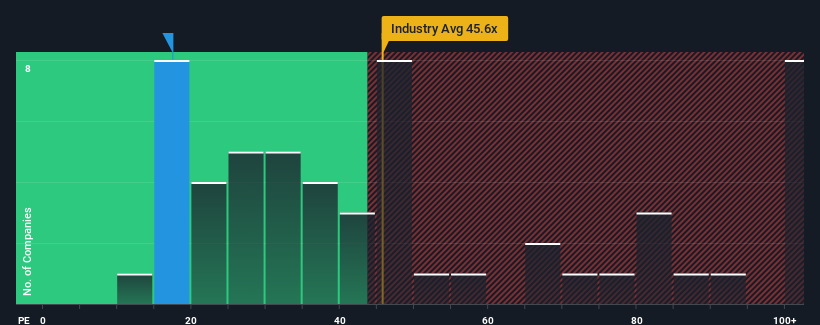

Even after such a large drop in price, Richinfo Technology's price-to-earnings (or "P/E") ratio of 17.4x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 50x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Richinfo Technology certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

How Is Richinfo Technology's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Richinfo Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 84% gain to the company's bottom line. Pleasingly, EPS has also lifted 151% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 5.3% over the next year. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

In light of this, it's understandable that Richinfo Technology's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Richinfo Technology's P/E

Richinfo Technology's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Richinfo Technology's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Richinfo Technology has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Richinfo Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.