The Hangzhou Onechance Tech Crop. (SZSE:300792) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

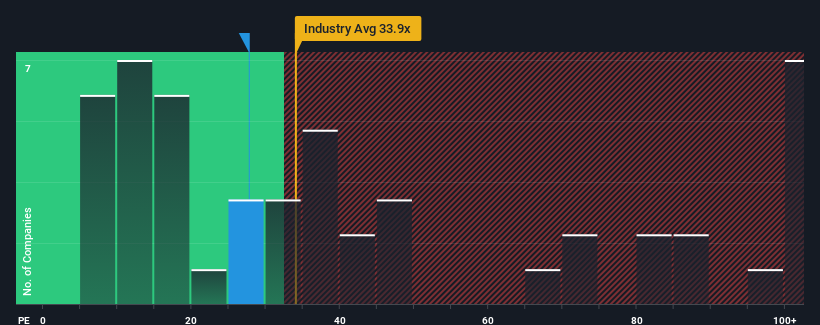

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Hangzhou Onechance Tech Crop's P/E ratio of 27.7x, since the median price-to-earnings (or "P/E") ratio in China is also close to 28x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Hangzhou Onechance Tech Crop as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Hangzhou Onechance Tech Crop would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 46%. As a result, earnings from three years ago have also fallen 54% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 80% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's curious that Hangzhou Onechance Tech Crop's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Hangzhou Onechance Tech Crop's plummeting stock price has brought its P/E right back to the rest of the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hangzhou Onechance Tech Crop currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Hangzhou Onechance Tech Crop you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.