Golden Matrix Group, Inc. (NASDAQ:GMGI) shares have had a really impressive month, gaining 39% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.1% over the last year.

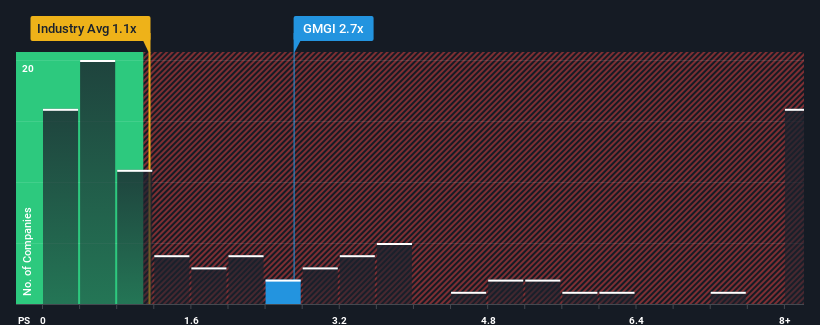

After such a large jump in price, you could be forgiven for thinking Golden Matrix Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.7x, considering almost half the companies in the United States' Entertainment industry have P/S ratios below 1.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Golden Matrix Group Has Been Performing

Recent times have been advantageous for Golden Matrix Group as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Golden Matrix Group.How Is Golden Matrix Group's Revenue Growth Trending?

In order to justify its P/S ratio, Golden Matrix Group would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 172% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this information, we can see why Golden Matrix Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Golden Matrix Group's P/S?

The large bounce in Golden Matrix Group's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Golden Matrix Group shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Golden Matrix Group has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.