EGing Photovoltaic Technology Co.,Ltd. (SHSE:600537) shares have had a horrible month, losing 28% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

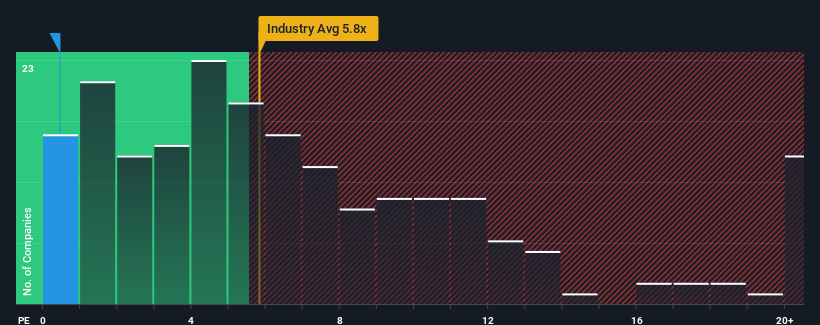

Since its price has dipped substantially, EGing Photovoltaic TechnologyLtd's price-to-sales (or "P/S") ratio of 0.4x might make it look like a strong buy right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios above 5.8x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

How Has EGing Photovoltaic TechnologyLtd Performed Recently?

With revenue growth that's exceedingly strong of late, EGing Photovoltaic TechnologyLtd has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for EGing Photovoltaic TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like EGing Photovoltaic TechnologyLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 55%. The strong recent performance means it was also able to grow revenue by 153% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 35% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that EGing Photovoltaic TechnologyLtd is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does EGing Photovoltaic TechnologyLtd's P/S Mean For Investors?

EGing Photovoltaic TechnologyLtd's P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of EGing Photovoltaic TechnologyLtd revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

You should always think about risks. Case in point, we've spotted 1 warning sign for EGing Photovoltaic TechnologyLtd you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.