For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Jiangsu Sihuan Bioengineering Co., Ltd (SZSE:000518) shareholders, since the share price is down 37% in the last three years, falling well short of the market decline of around 28%. Even worse, it's down 23% in about a month, which isn't fun at all. But this could be related to poor market conditions -- stocks are down 13% in the same time.

Since Jiangsu Sihuan Bioengineering has shed CN¥453m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Because Jiangsu Sihuan Bioengineering made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Jiangsu Sihuan Bioengineering saw its revenue shrink by 23% per year. That's definitely a weaker result than most pre-profit companies report. On the face of it we'd posit the share price fall of 11% compound, over three years is well justified by the fundamental deterioration. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

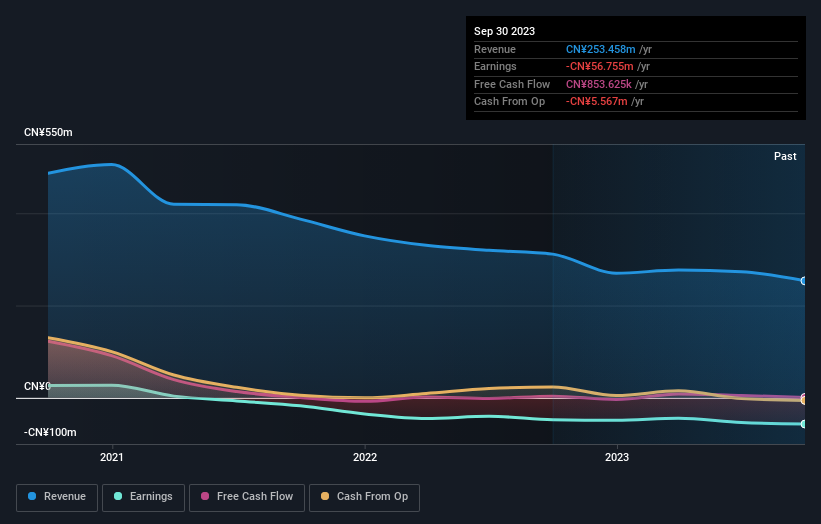

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Jiangsu Sihuan Bioengineering's earnings, revenue and cash flow.

A Different Perspective

Although it hurts that Jiangsu Sihuan Bioengineering returned a loss of 20% in the last twelve months, the broader market was actually worse, returning a loss of 24%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 0.3% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Jiangsu Sihuan Bioengineering better, we need to consider many other factors. Take risks, for example - Jiangsu Sihuan Bioengineering has 2 warning signs we think you should be aware of.

Of course Jiangsu Sihuan Bioengineering may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.