European stock markets fell on Thursday as Federal Reserve officials tried to adjust market expectations for when to cut interest rates, while bank stocks fell because some financial reports were disappointing.

The Stoke Europe 600 Index closed down 0.4% after Federal Reserve Chairman Jerome Powell said officials would be patient in taking action, dispelling market speculation that interest rate cuts would begin at the next meeting. BNP Paribas lowered its 2025 performance target, dragging down bank stocks. Dutch International Group warned of a possible decline in net interest income and a fall in stock prices.

In terms of other individual stocks, Adidas's stock price fell. Earlier, the company hinted that this year's profit would decline due to unfavorable exchange rate changes. Roche Holdings expects a weak recovery in sales and profits, and a fall in stock prices. Volvo Cars led the way in stock price gains after announcing that it would stop funding the struggling electric car maker Polestar.

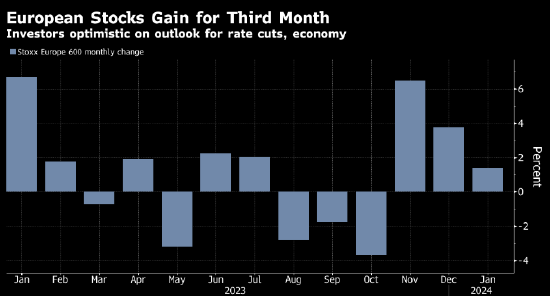

Previously, the European stock market rose for the third month in a row in January, setting a record for the longest continuous rise since August 2021. The rise was due to market optimism that interest rate cuts would soon arrive, and data showing that the Eurozone economy unexpectedly escaped recession in the second half of 2023. However, the latest comments from the Federal Reserve have raised concerns about the timing of policy easing. The Bank of England also kept interest rates unchanged today, in line with market expectations.