Unfortunately for some shareholders, the Shanghai Guijiu Co.,Ltd (SHSE:600696) share price has dived 27% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 50% in that time.

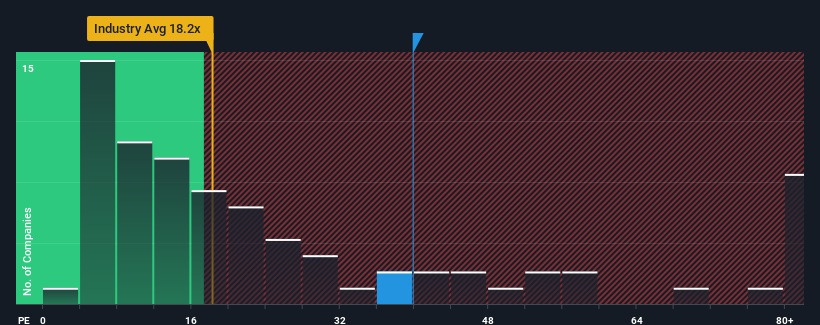

Even after such a large drop in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 27x, you may still consider Shanghai GuijiuLtd as a stock to potentially avoid with its 39.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Shanghai GuijiuLtd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Shanghai GuijiuLtd's Growth Trending?

In order to justify its P/E ratio, Shanghai GuijiuLtd would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 296% last year. Pleasingly, EPS has also lifted 1,629% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 42% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Shanghai GuijiuLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Shanghai GuijiuLtd's P/E

Despite the recent share price weakness, Shanghai GuijiuLtd's P/E remains higher than most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Shanghai GuijiuLtd revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Shanghai GuijiuLtd has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Shanghai GuijiuLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.