There are a few key trends to look for if we want to identify the next multi-bagger. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at AEM Holdings (SGX:AWX) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for AEM Holdings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.044 = S$29m ÷ (S$766m - S$96m) (Based on the trailing twelve months to September 2023).

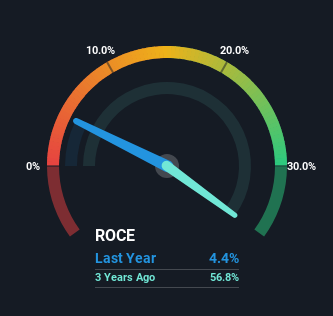

So, AEM Holdings has an ROCE of 4.4%. Ultimately, that's a low return and it under-performs the Semiconductor industry average of 6.4%.

In the above chart we have measured AEM Holdings' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Does the ROCE Trend For AEM Holdings Tell Us?

On the surface, the trend of ROCE at AEM Holdings doesn't inspire confidence. Around five years ago the returns on capital were 56%, but since then they've fallen to 4.4%. Given the business is employing more capital while revenue has slipped, this is a bit concerning. This could mean that the business is losing its competitive advantage or market share, because while more money is being put into ventures, it's actually producing a lower return - "less bang for their buck" per se.

On a related note, AEM Holdings has decreased its current liabilities to 13% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

The Bottom Line

From the above analysis, we find it rather worrisome that returns on capital and sales for AEM Holdings have fallen, meanwhile the business is employing more capital than it was five years ago. The market must be rosy on the stock's future because even though the underlying trends aren't too encouraging, the stock has soared 197%. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

Like most companies, AEM Holdings does come with some risks, and we've found 1 warning sign that you should be aware of.

While AEM Holdings isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.