The Shanghai Ailu Package Co., Ltd. (SZSE:301062) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 17% share price drop.

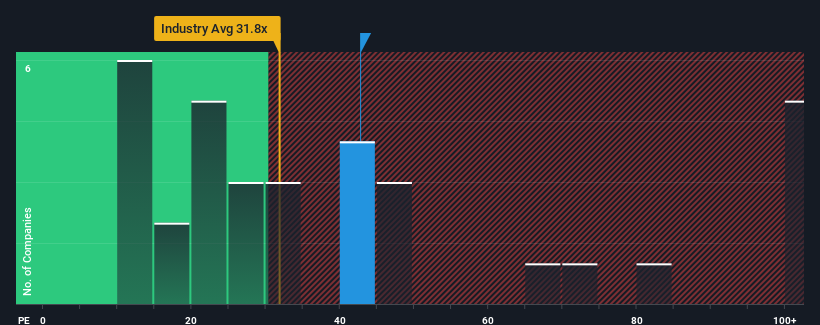

Although its price has dipped substantially, Shanghai Ailu Package's price-to-earnings (or "P/E") ratio of 42.7x might still make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 27x and even P/E's below 17x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Shanghai Ailu Package has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Is There Enough Growth For Shanghai Ailu Package?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shanghai Ailu Package's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 30% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 58% as estimated by the one analyst watching the company. With the market only predicted to deliver 42%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Shanghai Ailu Package's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shanghai Ailu Package's P/E?

Even after such a strong price drop, Shanghai Ailu Package's P/E still exceeds the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Shanghai Ailu Package's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Shanghai Ailu Package has 1 warning sign we think you should be aware of.

You might be able to find a better investment than Shanghai Ailu Package. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.