David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Tianjin Chase Sun Pharmaceutical Co.,Ltd (SZSE:300026) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Tianjin Chase Sun PharmaceuticalLtd

What Is Tianjin Chase Sun PharmaceuticalLtd's Debt?

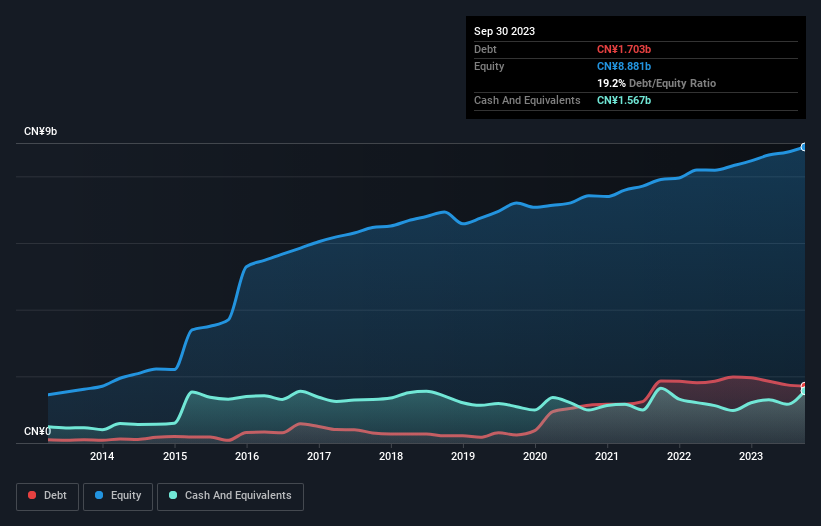

As you can see below, Tianjin Chase Sun PharmaceuticalLtd had CN¥1.70b of debt at September 2023, down from CN¥1.98b a year prior. However, it also had CN¥1.57b in cash, and so its net debt is CN¥136.3m.

How Healthy Is Tianjin Chase Sun PharmaceuticalLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Tianjin Chase Sun PharmaceuticalLtd had liabilities of CN¥1.86b due within 12 months and liabilities of CN¥1.64b due beyond that. On the other hand, it had cash of CN¥1.57b and CN¥3.22b worth of receivables due within a year. So it can boast CN¥1.29b more liquid assets than total liabilities.

This short term liquidity is a sign that Tianjin Chase Sun PharmaceuticalLtd could probably pay off its debt with ease, as its balance sheet is far from stretched. Carrying virtually no net debt, Tianjin Chase Sun PharmaceuticalLtd has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Tianjin Chase Sun PharmaceuticalLtd has a low net debt to EBITDA ratio of only 0.13. And its EBIT easily covers its interest expense, being 48.0 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The good news is that Tianjin Chase Sun PharmaceuticalLtd has increased its EBIT by 2.4% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is Tianjin Chase Sun PharmaceuticalLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Tianjin Chase Sun PharmaceuticalLtd recorded free cash flow of 29% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Happily, Tianjin Chase Sun PharmaceuticalLtd's impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. When we consider the range of factors above, it looks like Tianjin Chase Sun PharmaceuticalLtd is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Tianjin Chase Sun PharmaceuticalLtd that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.