3Peak Incorporated (SHSE:688536) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 66% share price decline.

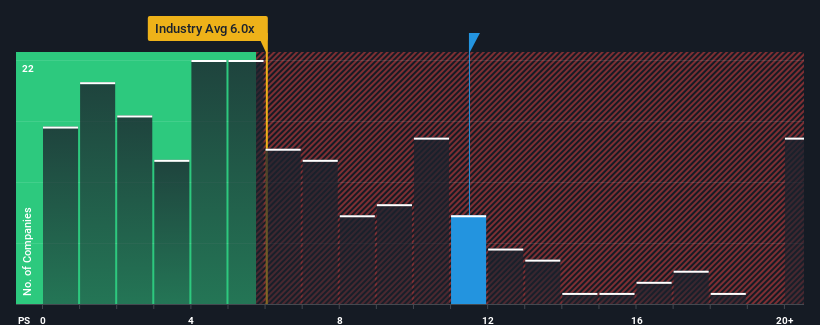

Although its price has dipped substantially, 3Peak may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 11.5x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 6x and even P/S lower than 3x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for 3Peak

What Does 3Peak's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, 3Peak's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think 3Peak's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

3Peak's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 41%. Even so, admirably revenue has lifted 97% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 56% as estimated by the six analysts watching the company. With the industry only predicted to deliver 36%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why 3Peak's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate 3Peak's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of 3Peak's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for 3Peak (1 is concerning) you should be aware of.

If these risks are making you reconsider your opinion on 3Peak, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.