Guangdong Guanghua Sci-Tech Co., Ltd. (SZSE:002741) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

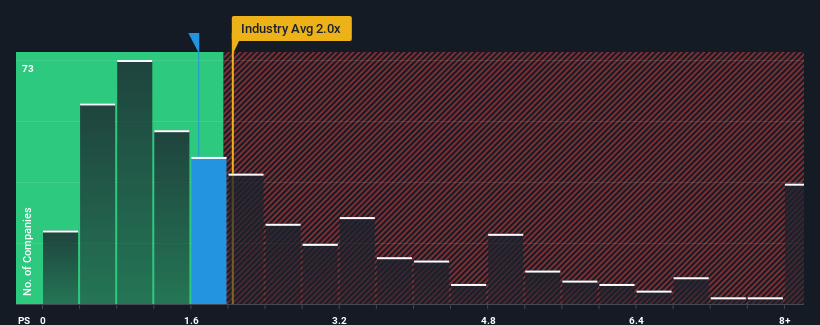

Although its price has dipped substantially, there still wouldn't be many who think Guangdong Guanghua Sci-Tech's price-to-sales (or "P/S") ratio of 1.7x is worth a mention when the median P/S in China's Chemicals industry is similar at about 2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Guangdong Guanghua Sci-Tech

How Has Guangdong Guanghua Sci-Tech Performed Recently?

While the industry has experienced revenue growth lately, Guangdong Guanghua Sci-Tech's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Guangdong Guanghua Sci-Tech will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Guangdong Guanghua Sci-Tech?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Guangdong Guanghua Sci-Tech's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. Even so, admirably revenue has lifted 40% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 102% over the next year. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Guangdong Guanghua Sci-Tech's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Guangdong Guanghua Sci-Tech looks to be in line with the rest of the Chemicals industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Guangdong Guanghua Sci-Tech's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Guangdong Guanghua Sci-Tech with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Guangdong Guanghua Sci-Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.