The Hanshang Group Co., Ltd. (SHSE:600774) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

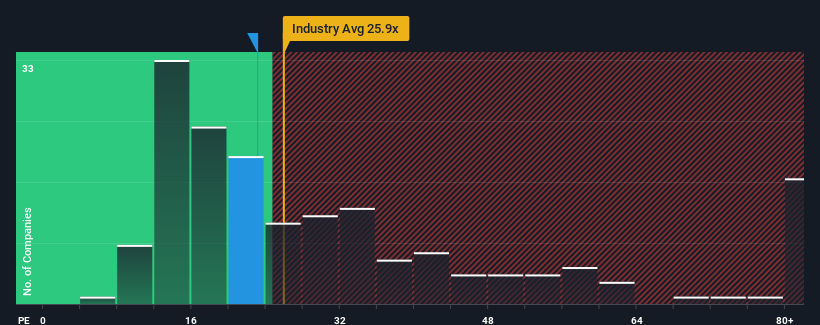

Since its price has dipped substantially, Hanshang Group may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 23.1x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 54x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We'd have to say that with no tangible growth over the last year, Hanshang Group's earnings have been unimpressive. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Hanshang Group

Is There Any Growth For Hanshang Group?

In order to justify its P/E ratio, Hanshang Group would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

This is in contrast to the rest of the market, which is expected to grow by 42% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Hanshang Group is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

The softening of Hanshang Group's shares means its P/E is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hanshang Group maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Hanshang Group is showing 2 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.