Shanghai Labway Clinical Laboratory Co., Ltd (SZSE:301060) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

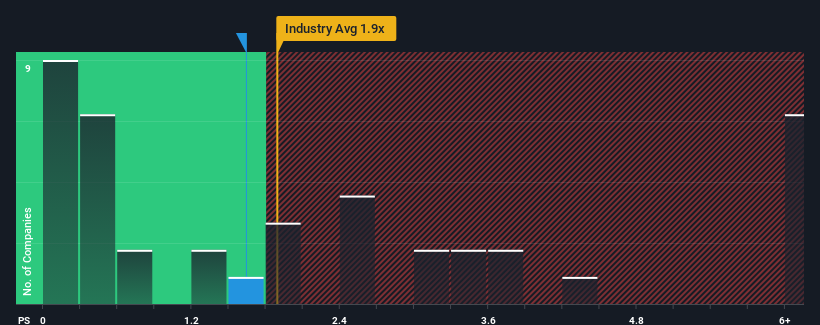

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Shanghai Labway Clinical Laboratory's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in China is also close to 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Shanghai Labway Clinical Laboratory

What Does Shanghai Labway Clinical Laboratory's P/S Mean For Shareholders?

For example, consider that Shanghai Labway Clinical Laboratory's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shanghai Labway Clinical Laboratory will help you shine a light on its historical performance.How Is Shanghai Labway Clinical Laboratory's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shanghai Labway Clinical Laboratory's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 35%. Still, the latest three year period has seen an excellent 91% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 19% shows it's noticeably more attractive.

In light of this, it's curious that Shanghai Labway Clinical Laboratory's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

With its share price dropping off a cliff, the P/S for Shanghai Labway Clinical Laboratory looks to be in line with the rest of the Healthcare industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Shanghai Labway Clinical Laboratory currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Shanghai Labway Clinical Laboratory you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.