Year-on-year decline in operating income

On January 31, the Bank of Xiamen released its 2023 performance report.

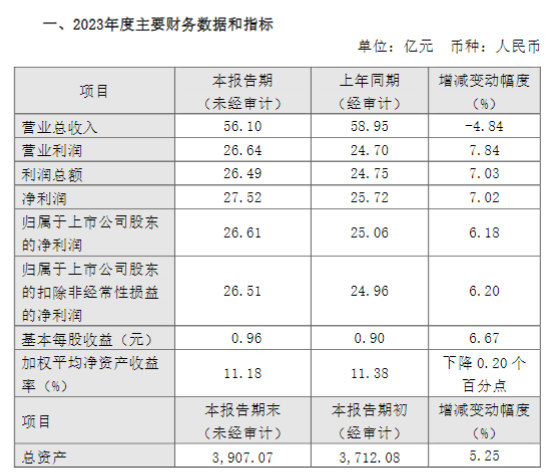

The report shows that in 2023, the Bank of Xiamen achieved operating income of 5.610 billion yuan, a year-on-year decrease of 4.84%; realized net profit attributable to shareholders of listed companies of 2,661 billion yuan, an increase of 6.18% over the previous year; and net assets per share attributable to common shareholders of listed companies were 9.05 yuan, an increase of 10.10% over the end of the previous year.

By the end of 2023, Bank of Xiamen had total assets of 390.707 billion yuan, up 5.25% from the end of the previous year, of which total loans and advances were 209.708 billion yuan, up 4.65% from the end of the previous year; total liabilities were 360,194 billion yuan, up 3.96% from the end of the previous year, of which total deposits were 207.582 billion yuan, up 1.32% from the end of the previous year.

In terms of asset quality, by the end of 2023, Bank of Xiamen's non-performing loan balance and non-performing loan ratio had both declined compared to the end of the previous year. By the end of 2023, the bank's non-performing loan ratio was 0.76%, down 0.10 percentage points from the end of the previous year; the provision coverage rate was 412.20%, up 24.27 percentage points from the end of the previous year, and asset quality indicators continued to be optimized.