Pixelworks, Inc. (NASDAQ:PXLW) shares have continued their recent momentum with a 28% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

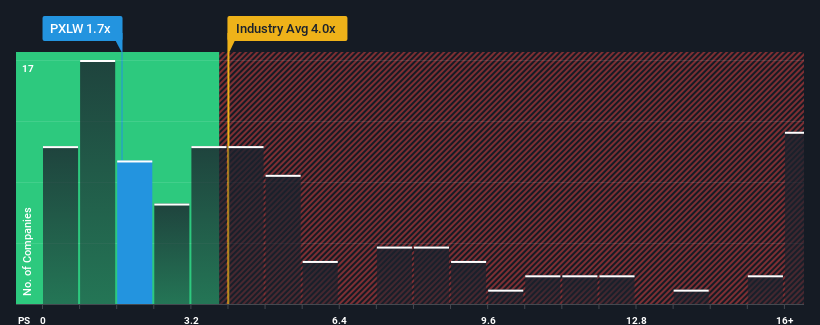

Even after such a large jump in price, Pixelworks' price-to-sales (or "P/S") ratio of 1.7x might still make it look like a strong buy right now compared to the wider Semiconductor industry in the United States, where around half of the companies have P/S ratios above 4x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Pixelworks

What Does Pixelworks' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Pixelworks' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pixelworks.Is There Any Revenue Growth Forecasted For Pixelworks?

The only time you'd be truly comfortable seeing a P/S as depressed as Pixelworks' is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 19%. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 25% over the next year. Meanwhile, the rest of the industry is forecast to expand by 44%, which is noticeably more attractive.

With this in consideration, its clear as to why Pixelworks' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Even after such a strong price move, Pixelworks' P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Pixelworks' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 3 warning signs for Pixelworks that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.