The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Betta Pharmaceuticals Co., Ltd. (SZSE:300558) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Betta Pharmaceuticals

What Is Betta Pharmaceuticals's Debt?

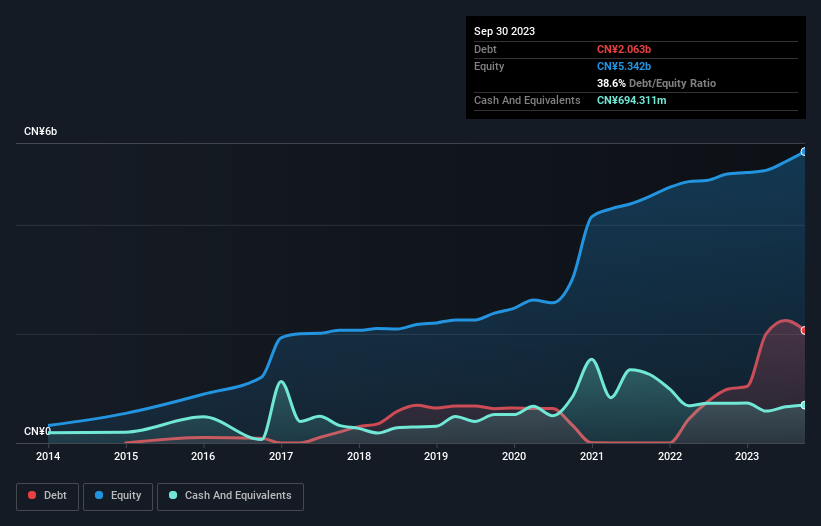

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Betta Pharmaceuticals had CN¥2.06b of debt, an increase on CN¥984.8m, over one year. On the flip side, it has CN¥694.3m in cash leading to net debt of about CN¥1.37b.

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Betta Pharmaceuticals had CN¥2.06b of debt, an increase on CN¥984.8m, over one year. On the flip side, it has CN¥694.3m in cash leading to net debt of about CN¥1.37b.

How Strong Is Betta Pharmaceuticals' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Betta Pharmaceuticals had liabilities of CN¥1.58b due within 12 months and liabilities of CN¥1.91b due beyond that. On the other hand, it had cash of CN¥694.3m and CN¥553.5m worth of receivables due within a year. So its liabilities total CN¥2.24b more than the combination of its cash and short-term receivables.

Of course, Betta Pharmaceuticals has a market capitalization of CN¥16.6b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Betta Pharmaceuticals has a quite reasonable net debt to EBITDA multiple of 2.1, its interest cover seems weak, at 1.6. This does suggest the company is paying fairly high interest rates. Either way there's no doubt the stock is using meaningful leverage. Notably, Betta Pharmaceuticals's EBIT launched higher than Elon Musk, gaining a whopping 316% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Betta Pharmaceuticals can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Betta Pharmaceuticals saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Betta Pharmaceuticals's conversion of EBIT to free cash flow and interest cover definitely weigh on it, in our esteem. But its EBIT growth rate tells a very different story, and suggests some resilience. We think that Betta Pharmaceuticals's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Betta Pharmaceuticals , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.