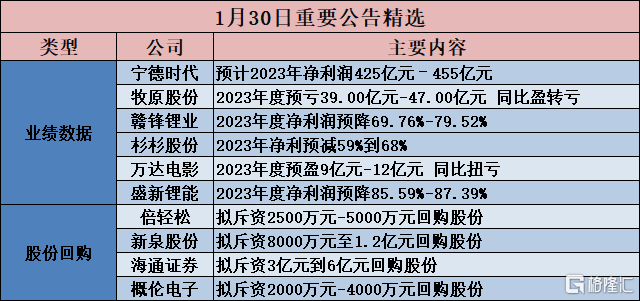

[Performance data]

Ningde Times (300750.SZ): Expected net profit of 42.5 billion yuan to 45.5 billion yuan in 2023

Ningde Times (300750.SZ) announced that it expects net profit of 4250,000 yuan to 45.5 million yuan in 2023, an increase of 38.31%-48.07% over the same period of the previous year, after deducting non-net profit of 38.50,000 yuan to 415.50 million yuan, an increase of 36.46%-47.09% over the same period last year. The new energy industry at home and abroad has maintained a relatively rapid growth rate, the power battery and energy storage industry market continues to grow, and the trend towards clean energy under the “dual carbon” target is clear. As the world's leading new energy innovation technology company, the company continues to launch industry-leading product solutions and services by increasing R&D investment and innovation efforts. During the reporting period, the company's new technologies and products were launched one after another, overseas market expansion accelerated, customer partnerships were further deepened, and while production and sales grew rapidly, it also achieved good economic benefits.

Ganfeng Lithium (002460.SZ): 2023 net profit pre-reduced by 69.76%-79.52%

Ganfeng Lithium (002460.SZ) announced its 2023 annual results forecast. Net profit attributable to shareholders of listed companies during the reporting period was RMB 420 million to RMB 620.00 million, down 79.52% — 69.76% from the same period last year; net profit profit after deducting non-recurring profit and loss was RMB 230,000,000 to RMB 340 million, down 88.47% — 82.96% from the same period last year; basic earnings per share were 2.09 yuan/share — 3.08 yuan/share.

Hengtong Optoelectronics (600487.SH): 2023 net profit pre-increased by 30% to 50%

Hengtong Optoelectronics (600487.SH) announced the 2023 annual results advance announcement. According to preliminary estimates by the finance department, it is estimated that net profit attributable to shareholders of listed companies in 2023 will be 2058.6016 million yuan to 237,530.95 million yuan. Compared with the same period last year, it will increase 475.619 million yuan to 7917.68 million yuan, an increase of 30% to 50% over the previous year. In 2023, net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss is expected to be RMB 187,91,165 million to RMB 22.337.62 million. Compared with the same period last year, it will increase by RMB 338.88571 million to RMB 69,311.67 million, an increase of 22.00% to 45.00% over the previous year.

600436.SH Earnings Report: 2023 net profit of $2,784 billion, up 12.59% year on year

Pien Tsai (600436.SH) announced its 2023 annual results report. Total operating revenue for the reporting period was RMB 10.035 billion, up 15.42% year on year; net profit attributable to shareholders of listed companies was RMB 2,784 billion, up 12.59% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was RMB 2,845 million, up 14.89% year on year. The company's total revenue increased 15.42% year-on-year, mainly due to the strengthening of market planning and expansion of sales channels, the sales revenue of the company, the holding subsidiary Fujian Pianziyi Health Technology Co., Ltd. (merger), and the holding subsidiary Pien Tsai (Zhangzhou) Pharmaceutical Co., Ltd. (merger).

Shanshan Co., Ltd. (600884.SH): Net profit pre-reduced by 59% to 68% in 2023

Shanshan Co., Ltd. (600884.SH) announced a pre-reduction announcement for the 2023 annual results. According to preliminary estimates by the finance department, net profit attributable to shareholders of listed companies is expected to be 860 million yuan to 110 million yuan in 2023. Compared with the same period of the previous year (statutory disclosure data), it will decrease by 1591.26 million yuan to 1831.26 million yuan, a decrease of 59% to 68% year-on-year. Net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss is between RMB 280 million and RMB 420 million. Compared with the same period of the previous year (statutory disclosure data), it will decrease by RMB 1,908.89 million to RMB 2048.89 million, a decrease of 82% to 88% year-on-year.

Baiyun Electric (603861.SH): Net profit forecast to increase by 138.27% to 236.38% in 2023

Baiyun Electric (603861.SH) announced its 2023 annual results forecast. According to preliminary estimates by the finance department, it is expected to achieve net profit of 85,000,000 yuan to 120,000,000 yuan in 2023. Compared with the same period of the previous year, it is expected to increase 49.3262 million yuan to 84.362 million yuan, an increase of 138.27% to 236.38% over the previous year. Net profit attributable to owners of the parent company is expected to be achieved in 2023 of 63.0 million yuan to 90.2 million yuan. Compared with the same period of the previous year, it is expected to increase 34.7664 million yuan to 63.7664 million yuan, an increase of 123.14% to 225.85% over the previous year.

Wanda Film (002739.SZ): 2023 pre-profit of 900 million yuan to 1.2 billion yuan, reversing year-on-year losses

Wanda Film (002739.SZ) announced its 2023 annual results forecast. Net profit attributable to shareholders of listed companies during the reporting period was 90,000 yuan to 120,000 yuan, with a loss of 19230.3 million yuan for the same period last year; net profit after deducting non-recurring profit and loss of 70,000 yuan — 100,000 yuan; loss of 208,08319 million yuan for the same period last year; basic earnings per share of 0.4130 yuan/share — 0.5506 yuan/share.

Shengxin Lithium Energy (002240.SZ): 2023 net profit pre-reduced by 85.59%-87.39%

Shengxin Lithium Energy (002240.SZ) announced its 2023 annual performance forecast. Net profit attributable to shareholders of listed companies during the reporting period was 70,000,000 yuan to 80,000,000 yuan, down 85.59%-87.39% from the same period last year; net profit profit after deducting non-recurring profit and loss was 13.0000 million yuan - 19.05 million yuan, down 96.48%-97.65% from the same period last year; basic profit income per share is 0.76 yuan/share - 0.87 yuan/share.

Makiyuan Co., Ltd. (002714.SZ): Projected loss of 390 billion yuan to 4.7 billion yuan in 2023 year-on-year profit to loss

Muyuan Co., Ltd. (002714.SZ) announced its 2023 annual results forecast, with a net profit loss of 3.800 billion yuan to 4.600 billion yuan during the reporting period, profit of 14.933 billion yuan; net profit loss attributable to shareholders of listed companies of 3100 billion yuan to 4.70 billion yuan, profit of 13.266 billion yuan for the same period last year; net profit loss after deducting non-recurring profit and loss of 3.70 billion yuan to 4.50 billion yuan, profit of 14.69 billion yuan for the same period last year; basic earnings loss of 0.73 yuan/share — 0.87 yuan/share.

Supor (002032.SZ): 2023 net profit pre-increased 4.95%-5.92%

Supor (002032.SZ) announced its 2023 annual results forecast, with operating income of 2130 million yuan, up 5.60% over the same period of the previous year; net profit attributable to shareholders of listed companies was 2.17 million yuan to 219 million yuan, up 4.95% to 5.92% over the same period of the previous year; net profit after deducting non-recurring profit and loss of 198,000,000 yuan to 200,000 yuan, up 4.86% to 5.92% over the same period last year; basic earnings per share were 2.71 yuan/share to 2.75 yuan/share .

[Repurchase]

Becoming Easy (688793.SH): Plans to spend 25 million yuan to 50 million yuan to buy back shares

Pei Easy (688793.SH) announced that all of the shares repurchased will be used to implement the employee stock ownership plan and equity incentive plan. The total capital used for the repurchase will not be less than RMB 25 million (inclusive) and no more than RMB 50 million (inclusive); the repurchase price will not exceed RMB 49.36 per share.

Xinquan Co., Ltd. (603179.SH): Plans to spend 80 million yuan to 120 million yuan to repurchase shares

Xinquan Co., Ltd. (603179.SH) announced that the company plans to repurchase shares to implement employee stock ownership plans or share incentives. The total capital of this repurchase is not less than RMB 80 million (inclusive) and no more than RMB 120 million (inclusive), and the share repurchase price is not more than RMB 55.00 per share (inclusive).

Haitong Securities (600837.SH): Plans to spend 300 million yuan to 600 million yuan to repurchase shares

Haitong Securities (600837.SH) announced that based on confidence in the company's future development prospects and recognition of the company's stock value, the company plans to buy back A-shares from the secondary market through centralized bidding transactions to protect the company's value and shareholders' rights. The minimum amount of the proposed repurchase capital is RMB 300 million (inclusive), the upper limit is RMB 600 million (inclusive), and the repurchase price does not exceed RMB 12.78 per share.

Guilun Electronics (688206.SH): Plans to spend 20 million yuan to 40 million yuan to buy back shares

Guilun Electronics (688206.SH) announced that the company plans to repurchase shares for employee stock ownership or equity incentive plans. The total repurchase capital shall not be less than RMB 20 million (inclusive) and not more than RMB 40 million (inclusive); the repurchase price shall not exceed RMB 30 per share (inclusive).