Investors can earn very close to the average market return by buying an index fund. In contrast individual stocks will provide a wide range of possible returns, and may fall short. Unfortunately, that's been the case for longer term DHC Software Co.,Ltd. (SZSE:002065) shareholders, since the share price is down 28% in the last three years, less than the market decline of around 22%. Furthermore, it's down 15% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 8.7% decline in the broader market, throughout the period.

The recent uptick of 4.3% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for DHC SoftwareLtd

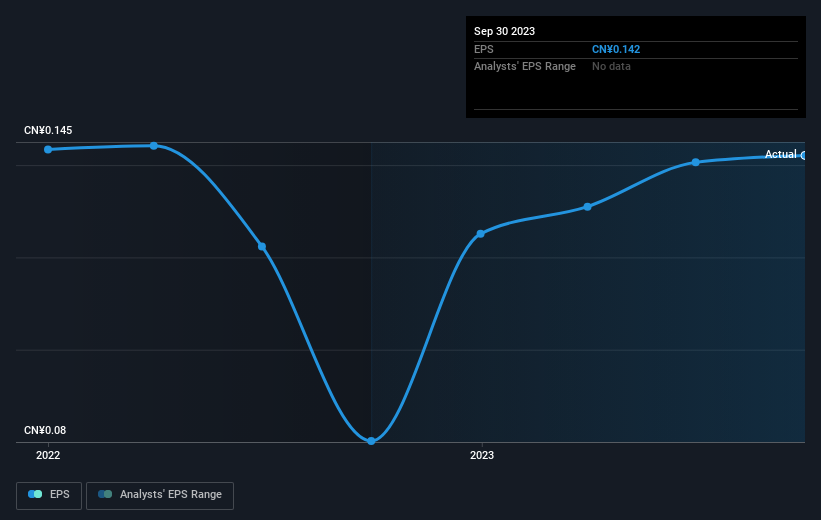

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

DHC SoftwareLtd saw its EPS decline at a compound rate of 0.2% per year, over the last three years. The share price decline of 10% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on DHC SoftwareLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's certainly disappointing to see that DHC SoftwareLtd shares lost 14% throughout the year, that wasn't as bad as the market loss of 18%. Given the total loss of 3% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand DHC SoftwareLtd better, we need to consider many other factors. For example, we've discovered 3 warning signs for DHC SoftwareLtd (1 is potentially serious!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.