Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Guangzhou Automobile Group Co., Ltd. (HKG:2238) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Guangzhou Automobile Group

What Is Guangzhou Automobile Group's Net Debt?

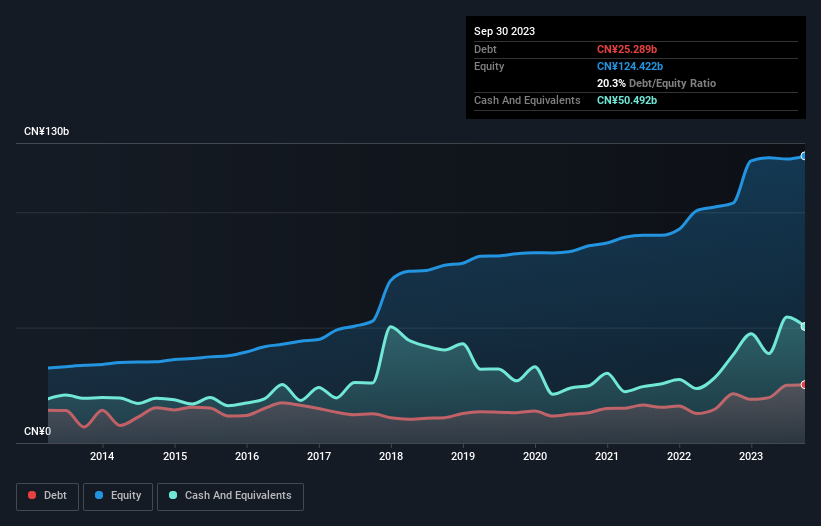

The image below, which you can click on for greater detail, shows that at September 2023 Guangzhou Automobile Group had debt of CN¥25.3b, up from CN¥21.3b in one year. However, its balance sheet shows it holds CN¥50.5b in cash, so it actually has CN¥25.2b net cash.

How Strong Is Guangzhou Automobile Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Guangzhou Automobile Group had liabilities of CN¥68.8b due within 12 months and liabilities of CN¥17.0b due beyond that. On the other hand, it had cash of CN¥50.5b and CN¥10.0b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥25.2b.

While this might seem like a lot, it is not so bad since Guangzhou Automobile Group has a market capitalization of CN¥71.7b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Despite its noteworthy liabilities, Guangzhou Automobile Group boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Guangzhou Automobile Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Guangzhou Automobile Group reported revenue of CN¥128b, which is a gain of 27%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Guangzhou Automobile Group?

While Guangzhou Automobile Group lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of CN¥4.5b. So taking that on face value, and considering the cash, we don't think its very risky in the near term. The good news for Guangzhou Automobile Group shareholders is that its revenue growth is strong, making it easier to raise capital if need be. But we still think it's somewhat risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 3 warning signs we've spotted with Guangzhou Automobile Group .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.