Antengene Corporation Limited (HKG:6996) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

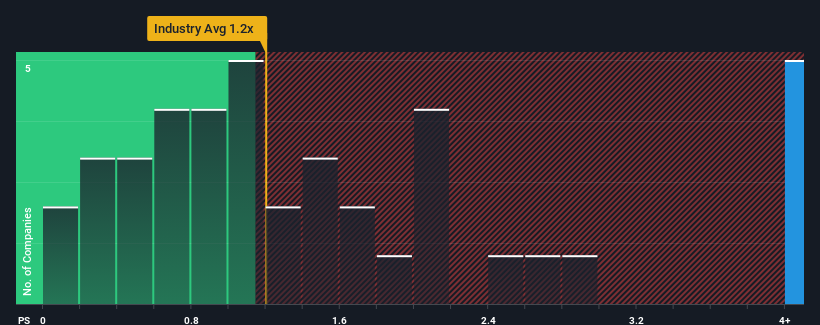

In spite of the heavy fall in price, you could still be forgiven for thinking Antengene is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.1x, considering almost half the companies in Hong Kong's Pharmaceuticals industry have P/S ratios below 1.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Antengene

What Does Antengene's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Antengene has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Antengene's future stacks up against the industry? In that case, our free report is a great place to start.How Is Antengene's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Antengene's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 115% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 76% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Antengene's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Even after such a strong price drop, Antengene's P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Antengene shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Antengene is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Antengene's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.