Zhejiang Huatong Meat Products Co., Ltd. (SZSE:002840) shareholders might be concerned after seeing the share price drop 15% in the last month. But that doesn't change the fact that shareholders have received really good returns over the last five years. In fact, the share price is 114% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now.

Since the long term performance has been good but there's been a recent pullback of 5.3%, let's check if the fundamentals match the share price.

View our latest analysis for Zhejiang Huatong Meat Products

Zhejiang Huatong Meat Products wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Zhejiang Huatong Meat Products can boast revenue growth at a rate of 9.7% per year. That's a pretty good long term growth rate. We'd argue this growth has been reflected in the share price which has climbed at a rate of 16% per year over in that time. Given that the business has made good progress on the top line, it would be worth taking a look at the growth trend. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

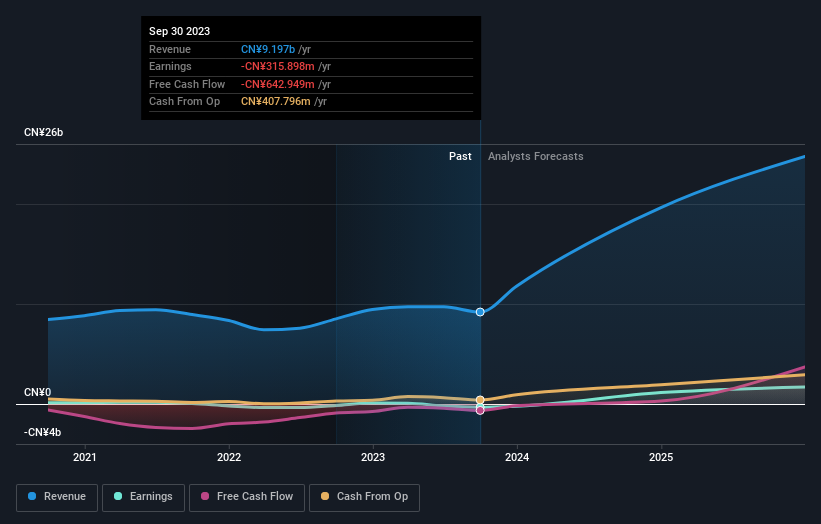

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Zhejiang Huatong Meat Products' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Zhejiang Huatong Meat Products shareholders have received a total shareholder return of 3.2% over one year. That's including the dividend. However, the TSR over five years, coming in at 17% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Zhejiang Huatong Meat Products you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.