Ningbo Shenglong Automotive Powertrain System Co.,Ltd. (SHSE:603178) shareholders might be rather concerned because the share price has dropped 35% in the last month. But that doesn't change the fact that shareholders have received really good returns over the last five years. In fact, the share price is 284% higher today. To some, the recent pullback wouldn't be surprising after such a fast rise. The more important question is whether the stock is too cheap or too expensive today.

While the stock has fallen 7.9% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Ningbo Shenglong Automotive Powertrain SystemLtd

We don't think that Ningbo Shenglong Automotive Powertrain SystemLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Ningbo Shenglong Automotive Powertrain SystemLtd saw its revenue grow at 4.5% per year. Put simply, that growth rate fails to impress. In comparison, the share price rise of 31% per year over the last half a decade is pretty impressive. While we wouldn't be overly concerned, it might be worth checking whether you think the fundamental business gains really justify the share price action. Some might suggest that the sentiment around the stock is rather positive.

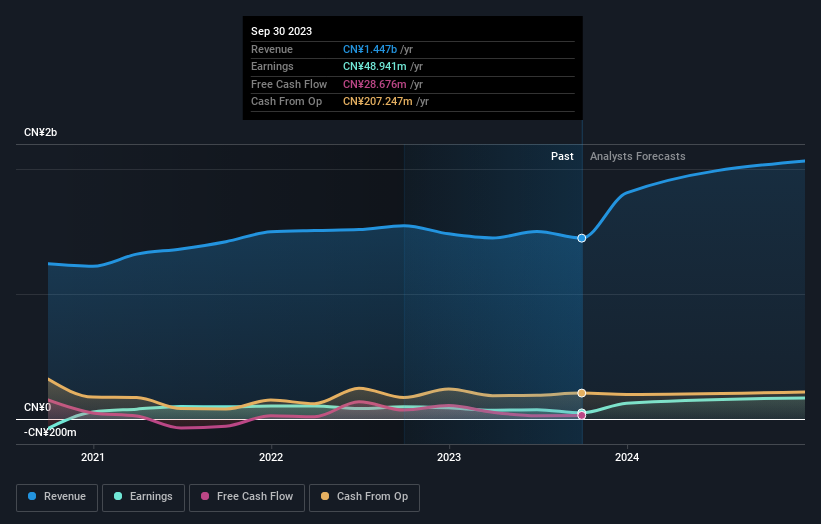

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Ningbo Shenglong Automotive Powertrain SystemLtd stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Ningbo Shenglong Automotive Powertrain SystemLtd the TSR over the last 5 years was 298%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Ningbo Shenglong Automotive Powertrain SystemLtd shareholders have received a total shareholder return of 222% over one year. That's including the dividend. That gain is better than the annual TSR over five years, which is 32%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Ningbo Shenglong Automotive Powertrain SystemLtd (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

Of course Ningbo Shenglong Automotive Powertrain SystemLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.