One simple way to benefit from a rising market is to buy an index fund. In contrast individual stocks will provide a wide range of possible returns, and may fall short. The Hangzhou Zhongheng Electric Co., Ltd (SZSE:002364) is such an example; over three years its share price is down 31% versus a marketdecline of 26%. The falls have accelerated recently, with the share price down 20% in the last three months. Of course, this share price action may well have been influenced by the 8.3% decline in the broader market, throughout the period.

If the past week is anything to go by, investor sentiment for Hangzhou Zhongheng Electric isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Hangzhou Zhongheng Electric

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

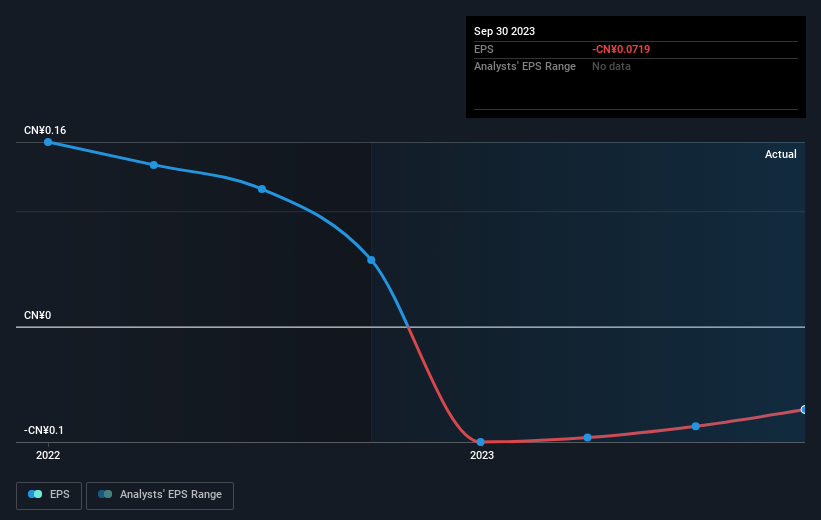

Over the three years that the share price declined, Hangzhou Zhongheng Electric's earnings per share (EPS) dropped significantly, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While it's certainly disappointing to see that Hangzhou Zhongheng Electric shares lost 14% throughout the year, that wasn't as bad as the market loss of 20%. Given the total loss of 4% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Hangzhou Zhongheng Electric that you should be aware of before investing here.

Of course Hangzhou Zhongheng Electric may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.