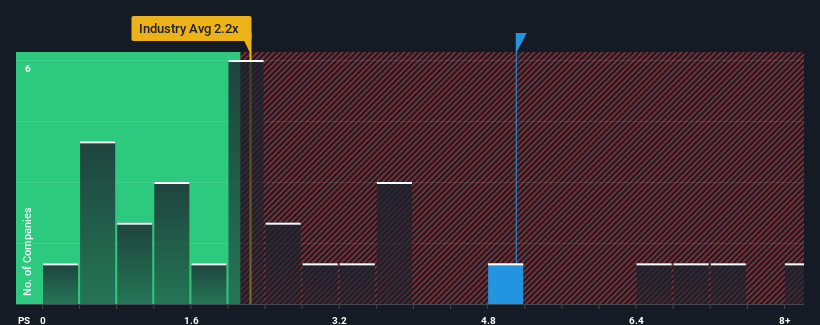

When you see that almost half of the companies in the Energy Services industry in China have price-to-sales ratios (or "P/S") below 2.2x, Houpu Clean Energy Group Co., Ltd. (SZSE:300471) looks to be giving off strong sell signals with its 5.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Houpu Clean Energy Group

How Has Houpu Clean Energy Group Performed Recently?

The revenue growth achieved at Houpu Clean Energy Group over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Houpu Clean Energy Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Houpu Clean Energy Group?

The only time you'd be truly comfortable seeing a P/S as steep as Houpu Clean Energy Group's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. The latest three year period has also seen an excellent 64% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that Houpu Clean Energy Group's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Bottom Line On Houpu Clean Energy Group's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't expect to see Houpu Clean Energy Group trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Houpu Clean Energy Group you should know about.

If you're unsure about the strength of Houpu Clean Energy Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.