Will a scene from history be repeated?

In the past three quarters, every time Tesla reported earnings, the stock price had to plummet by 10 points on the same day.

The decline in gross margin and the sharp decline in net profit are important reasons, but after that, Tesla will rebound strongly again. When it is strong, it can double, and when it is weak, it can also increase by 30%.

If we only look at historical trends, Tesla's earnings report falls to the bottom after falling sharply, the yield is pretty good. Coupled with financial reports falling short of expectations, the valuation of US stocks will generally be completed in a short period of time. As long as there are favorable and bears make up, the certainty of an increase is quite high.

Tonight, Tesla will release earnings data for the fourth quarter. Will it drop sharply this time and then rebound?

01

How will it perform?

As for tonight's earnings report, the market has given consistent expectations:

The fourth quarter is expected to record revenue of US$25.764 billion, up 5.95% year on year; earnings per share of US$0.62, down 42.11% year on year. This performance is quite bleak; in particular, net profit is close to falling short.

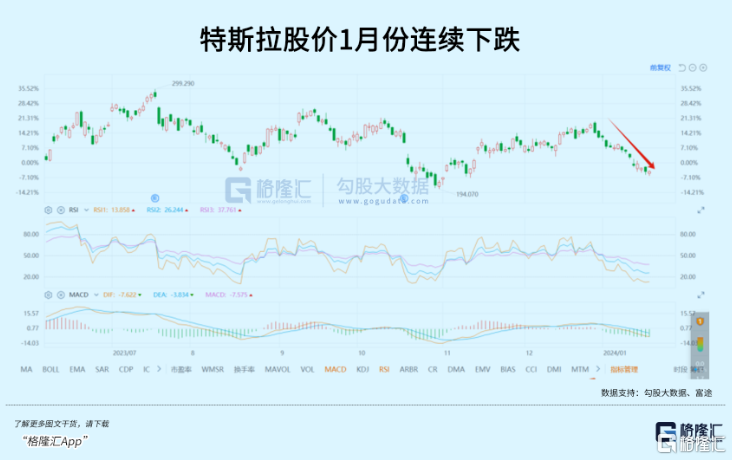

According to data released at the beginning of the month, Tesla's production and sales in the fourth quarter were slightly higher than expected, producing about 495,000 cars and delivering more than 484,000 vehicles. In 2023, Tesla's car deliveries increased 38% year over year to 1.81 million units, exceeding its previously set target of 1.8 million vehicles, but falling short of Musk's target of 2 million vehicles. Although deliveries have reached a record high, the capital market's response to this news has been lackluster, and the stock price has already fallen by nearly 20% within this month.

In the fourth quarter earnings report, the market is still most concerned about the company's gross margin level.

As the most important observation indicator for each quarter, the overall gross margin for 23Q3 was only 17.9%. Excluding regulatory credit, the gross profit margin for cars is only 16.3%, the lowest in recent years. Judging from historical data, in the past six quarters, Tesla's gross bicycle profit fell from 17,865 US dollars to 8,431 US dollars, a drop of as much as 53%. If Q4 gross margin continues to fall, then it will be difficult for stock prices to stop.

Tesla raised the prices of cars sold in China four times in a row in November of last year, hoping to attract special fans who bought more or less. This was originally a good thing. Coupled with the centralized delivery of the new M3, the gross margin in the domestic market should be good. But at the same time, in the last quarter of 2023, Tesla will lower the prices of inventory cars sold in the US and Canada. Comparing the two, it is likely to hedge against China's benefits.

This is also the possibility that Q4 gross margin will continue to weaken, which the market is very worried about. In addition to gross margin, Tesla's 2024 sales guidelines and whether there are new business growth points are also important concerns in the market.

The bad part is that investment banks are all pessimistic about this. Wells Fargo expects Tesla deliveries to grow by only about 13% over the next year, far below the 50% long-term target set by the company. Some investment banks even expect Tesla to deliver 1.97 million cars in 2024, which is lower than the market's forecast of 2.19 million cars, and the delivery volume increased by only 9% over the same period last year.

Of course, if the final results exceed expectations and the expectations given for this year will be relatively good, then the stock price is unlikely to fall; on the contrary, it will usher in a rebound. Because Tesla has already dropped 20% this month, and the technical side also has the basis for a rebound, everything can only be about earnings reports and Musk's statements.

02

If it falls sharply, can you copy it?

In the past three quarterly earnings days, Tesla plummeted and then polished for one to two weeks. The longest was the Q2 earnings report. After falling for a month, it then rose again. The rebound was quite objective. Among them, it doubled after the Q1 earnings report.

In fact, the market has always been very enthusiastic about companies like Tesla, which are full of future growth stories, because whether it's car sales, FSD, or even more distant AI and robots, they are all very attractive, but the core of trading is if it actually falls sharply this time, how deep will it be?

If it isn't deep enough, the appeal will not be enough, and the extent of the subsequent rebound will be quite limited, making it difficult to attract large amounts of capital into the market.

Recently, however, Tesla's downturn is surrounding price cuts in China and Europe, a sharp drop in tax benefits in the US, and the Red Sea incident disrupted the supply chain, causing the German factory to shut down until the end of the month. Taxi company Hertz sold old Tesla cars. Recently, it was also revealed that Musk is demanding 25% of voting rights, otherwise it will develop AI outside of Tesla... The stock price has already dropped over a round.

Originally, we expected Tesla's stock price to be around 200, which would be a pretty good layout range, but this analysis based on technical aspects has been greatly disrupted by recent negative events, and may still move downward to reflect the impact of the negative event on the Tesla incident.

Throughout 2024, we tend to think of it as Tesla's “Little Year.” Because until now, we haven't seen Tesla's new growth point land. Cybertruck orders are huge, but delivery capacity has always been limited, and the rumored Model 2 has been slow to come to light. Although there has been some progress in FSD commercialization, there are still few countries and regions that hinder it, and AI cloud services and robots are even farther away.

If there are no surprises, how can Tesla talk about a growing stock market this year to gain the favor of the capital market?

I think Musk would also have a headache if he wanted to answer this question. He could only read the financial report and what Musk said on the conference call before making an evaluation.

03

Tesla's valuation myths

Tesla's high valuation, and its difficulty in quantifying, has always been the most controversial point in the market.

Believers say that Tesla's future is a sea of stars, and there is nothing wrong with giving high valuations; critics often use sales and profit margin data to prove that Tesla simply does not deserve such a high valuation. After all, a car company with sales of only 2 million can have a market value higher than the market value of the top ten car companies in the world combined, which in itself is quite ridiculous.

Both sides have certain reasons; this is actually a question of whether it is in the near term or the long term.

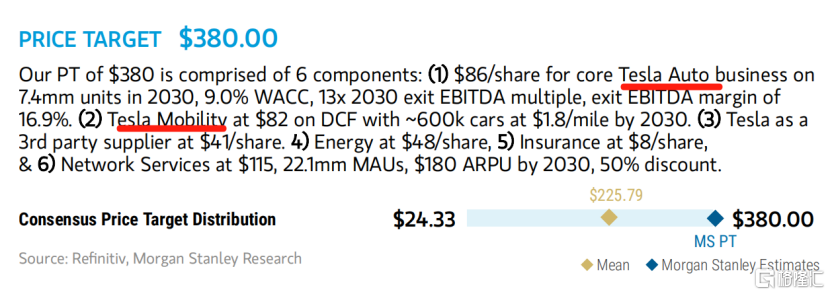

The most famous Tesla boss, once saw Tesla's stock price of 2,000 US dollars, which is 10 times what it is now. The reason is that Tesla's autonomous driving and taxi business are worth sticking to. There is also a large Tesla motorcycle, which recently offered a target price of 380 US dollars. Although it is lower than Sister Mu Tou, it does represent the market's optimism about Tesla's future.

Moreover, if you take a close look at the target price composition of the big motorcycle, you can get a relatively objective value anchor for Tesla's future.

Tesla's target price for big motorcycles

This $380 includes 6 components:

(1) The core automobile business, based on annual sales volume of 7.4 million in 2030, WACC 9.0%, an EBITDA multiple of 13, an EBITDA margin of 16.9%, worth 86 US dollars;

(2) Autonomous taxis. In the case of 600,000 vehicles in 2030, the DCF of each vehicle is 1.8 US dollars/mile, worth 82 US dollars;

(3) Tesla as a third party supplier, worth 41 US dollars;

(4) Energy business, worth $48;

(5) Auto insurance, worth $8;

(6) Internet service, 22.1 million monthly active accounts, $180 ARPU, 50% discount, worth $115.

This is the highest price target price for Tesla given by investment banks in a few months, because they are all calculated in 2030. There is still a lot of uncertainty in the middle, but it can also give us some fresh thoughts.

I think the most valuable one is counting the first one, with an annual sales volume of 7.4 million, corresponding to a stock price of only 86 US dollars. We still believe in the professionalism of the Damo model. What conclusion can we draw here?

The first point is that Tesla's valuation is indeed inflated. In the case of the automobile business, even if converted to 2030, the annual sales of 7.4 million cars would be worth 86 US dollars, not to mention only 1.81 million units now.

Second, if Tesla's stock price actually falls to 86 US dollars, it can also be bottomed out, because the automobile business can be clearly calculated. As for autonomous driving, cloud services, and robots, who knows? Moreover, with an annual sales of 7.4 million cars, there should be no problem for Tesla. Even if not 2030, it can be achieved in 2031 and 2032.

The conclusion may seem very contradictory, but at least it shows that for the valuation of Tesla, we should establish a basic anchoring condition, that is, the automobile business. The reason is that this business can be clearly calculated, and other businesses that cannot be clearly calculated. You can think of it as an option or an incremental part. It doesn't matter how much value can go; even an increase of one dollar is an increase in value.

However, Tesla is still above $200, which is really not good from a margin of safety perspective. Therefore, we can only hope that this financial report will push the stock price a little deeper. After all, a sharp drop in stock prices for companies like Tesla is an opportunity.

04

epilogue

Overall, Tesla's growth potential is huge, because every business has a lot of room for growth, and even if the final car sales reach Toyota's level, there is still room to increase by 5 times. FSD, AI cloud services, and robots are even more storytelling. Therefore, when it comes to growth, there is much to be seen; there is no need to get tangled up.

In Tesla's valuation, the part that is clearly calculated and the options are still very large, and it is even possible that the options part is far more clear than the calculation (automobile business). Because Tesla has too many future things that are reflected in the valuation in advance, there are too many things waiting for the future to be realized, and you can't prove or falsify these things, this is the source of Tesla's high volatility.

If some new information occurs, whether good or bad, the market will quickly adjust its assessment of its value, causing the stock price to rise or fall. Therefore, the high volatility of Tesla's stock price will not go away. This can also be seen from stock and options trading. Tesla has basically topped the top position in daily US stock trading volume. Recently, it has only been surpassed by Nvidia on sporadic days. Options betting is also very active. There are also more than 8 million unclosed contracts, which is double that of Nvidia.

Of course, the advantage of active trading is that there is no need to worry about liquidity issues. If you can effectively seize swing opportunities, the benefits are still quite good.

Finally, if you want to make money by investing in Tesla, these are the two most simple operations:

If Tesla falls sharply, or falls 20% or even 30% + from a high level, it can be used as an opportunity to rebound in stages. After rebounding to a high level, it can be sold, but this is only technical and suitable for short-term operation;

If it's a medium- to long-term investment and acknowledges Tesla's value, you can also open a position little by little at every sharp drop and then lie back and wait for the gift of time. (End of full text)