Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Zhejiang Zhongcheng Packing Material Co., Ltd. (SZSE:002522) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Zhejiang Zhongcheng Packing Material

What Is Zhejiang Zhongcheng Packing Material's Debt?

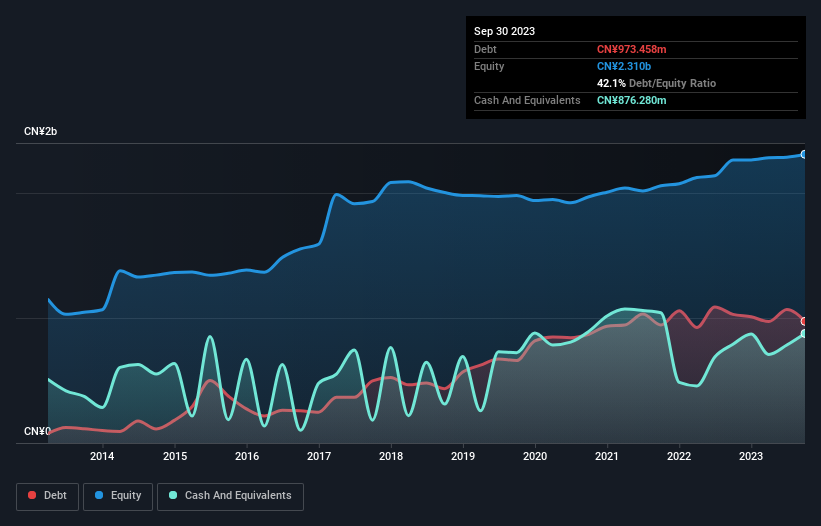

As you can see below, Zhejiang Zhongcheng Packing Material had CN¥973.5m of debt at September 2023, down from CN¥1.03b a year prior. However, it also had CN¥876.3m in cash, and so its net debt is CN¥97.2m.

A Look At Zhejiang Zhongcheng Packing Material's Liabilities

We can see from the most recent balance sheet that Zhejiang Zhongcheng Packing Material had liabilities of CN¥990.7m falling due within a year, and liabilities of CN¥314.2m due beyond that. On the other hand, it had cash of CN¥876.3m and CN¥146.7m worth of receivables due within a year. So its liabilities total CN¥281.9m more than the combination of its cash and short-term receivables.

Of course, Zhejiang Zhongcheng Packing Material has a market capitalization of CN¥3.75b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Zhejiang Zhongcheng Packing Material has net debt of just 0.40 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 9.2 times, which is more than adequate. In fact Zhejiang Zhongcheng Packing Material's saving grace is its low debt levels, because its EBIT has tanked 48% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Zhejiang Zhongcheng Packing Material's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Zhejiang Zhongcheng Packing Material recorded free cash flow of 35% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Zhejiang Zhongcheng Packing Material's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to handle its debt, based on its EBITDA, is pretty flash. Looking at all this data makes us feel a little cautious about Zhejiang Zhongcheng Packing Material's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Zhejiang Zhongcheng Packing Material , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.