The Shenzhen Magic Design & Decoration Engineering Co., Ltd. (SZSE:002856) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. Indeed, the recent drop has reduced its annual gain to a relatively sedate 5.8% over the last twelve months.

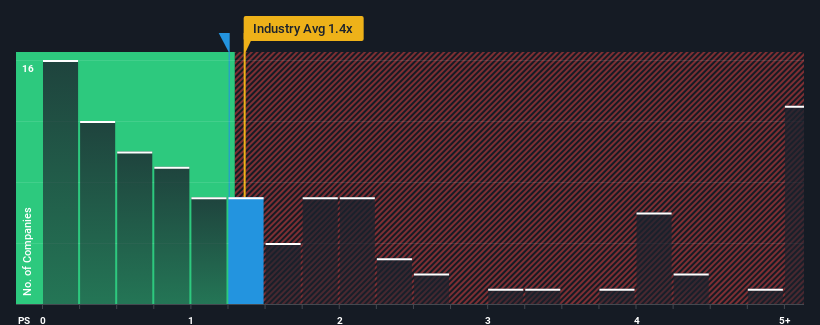

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Shenzhen Magic Design & Decoration Engineering's P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Construction industry in China is also close to 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Shenzhen Magic Design & Decoration Engineering

What Does Shenzhen Magic Design & Decoration Engineering's P/S Mean For Shareholders?

For instance, Shenzhen Magic Design & Decoration Engineering's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Shenzhen Magic Design & Decoration Engineering, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Shenzhen Magic Design & Decoration Engineering?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shenzhen Magic Design & Decoration Engineering's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.5%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 7.9% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

With this information, we find it interesting that Shenzhen Magic Design & Decoration Engineering is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Following Shenzhen Magic Design & Decoration Engineering's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Shenzhen Magic Design & Decoration Engineering revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you take the next step, you should know about the 2 warning signs for Shenzhen Magic Design & Decoration Engineering (1 doesn't sit too well with us!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.