Production reached a record high in 2023

After experiencing seven rounds of price increases last year, in the first month of the 2024 new year, the price increase sentiment in the titanium dioxide market became stronger, and most companies ushered in the first rise of the year.

Among them, titanium dioxide leader Huiyun Titanium announced the first round of price increases for products in the new year. Among them, the sales price of domestic products increased by 700 yuan/ton, and export products increased by 100 US dollars/ton.

It is worth mentioning that as the Spring Festival approaches, logistics and transportation issues are compounded. Dealers and downstream factories have basically completed preparation of goods before the holiday season. Currently, the domestic titanium dioxide market as a whole is showing a low season of reduced supply combined with demand. In this context, in addition to the price increase of titanium dioxide companies, it is remarkable.

The first increase at the beginning of the year

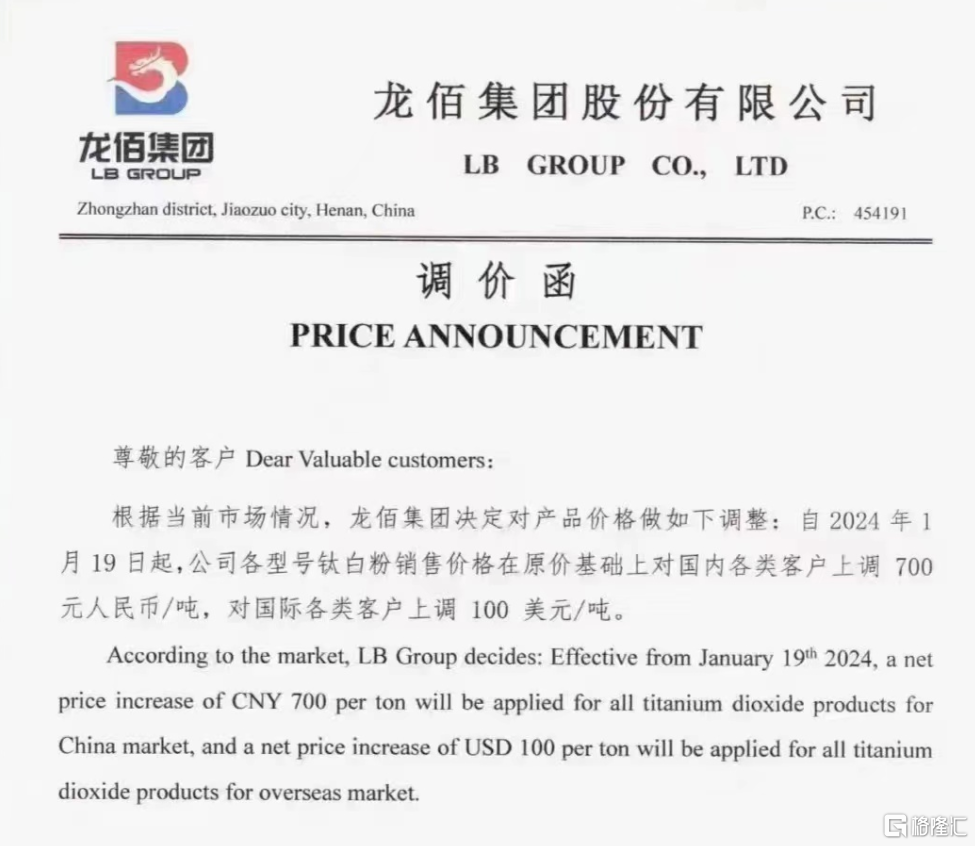

On January 19, Longbai Group issued a price adjustment letter. According to the current market situation, Longbai Group decided to make the following adjustments to product prices: Starting January 19, 2024, the sales price of the company's various types of titanium dioxide will increase by 700 yuan/ton for various domestic customers and 100 US dollars/ton for various international customers.

At the beginning of the year, Longbai Group issued a price adjustment letter on December 6, 2023, which took effect on January 1, 2024. The sales price of the company's various types of titanium dioxide was raised by 100 US dollars/ton for various international customers on the basis of the original price.

On the same day, China Nuclear Titanium White, the second-largest titanium dioxide company in China, also issued a price adjustment letter. According to the current situation in the titanium dioxide market, the sales price of each type of titanium dioxide will be adjusted as follows: starting January 19, 2024, the sales price of various types of titanium dioxide will be adjusted as follows: domestic customers will increase by 500 yuan/ton, and international customers will increase by 100 US dollars/ton.

Huiyun Titanium also followed the price increase. Starting January 19, the sales price of the company's various types of titanium dioxide will be adjusted on the basis of the existing sales price of titanium dioxide. Sales prices for various customers in China increased by 700 yuan/ton, and export prices for various international customers increased by 100 US dollars/ton.

The announcement also proposed that the company will closely track the price trend of titanium dioxide and changes in the supply and demand situation, and adjust the price of the product in a timely manner. This product price adjustment is expected to have a positive impact on the company's overall performance improvement.

Industry insiders pointed out that the increase in the price of titanium dioxide reflects the recovery of the global economy, especially the growing demand for titanium dioxide in developed markets. As the world's largest producer of titanium dioxide, China has rich resources and advanced technology to meet the needs of the global market.

The titanium dioxide market is booming

Looking back at the titanium dioxide market in 2023, production once again reached a new high.Statistics from the Titanium Dioxide Industry Technology Innovation Strategic Alliance Secretariat show that in 2023, the total output of China's titanium dioxide industry reached 4.16 million tons, a year-on-year increase of 6.3%.

According to the Secretary General of the Titanium Dioxide Alliance, there will be 42 full-process titanium dioxide manufacturers with normal production conditions in the national titanium dioxide industry in 2023. Among them, 28 companies increased production, accounting for 66.67%; production declined in 11 companies, accounting for 26.19%. At the end of 2023, 42 full-process titanium dioxide companies had an effective production scale of 5.2 million tons/year, and the average capacity utilization rate of the industry was 80%, down 3 percentage points from the previous year.

In terms of price,The overall titanium dioxide market fluctuated narrowly in 2023. At the beginning of the year, the average price of titanium dioxide in China was 15933.33 yuan/ton, and the average price at the end of the year was 16,483.33 yuan/ton. The overall price increased by 3.45% during the year.

In recent years, the international market has been one of the pillars of China's titanium dioxide market, and exports basically account for about 1/3 of production. According to customs data, from January to November 2023, China imported a total of about 73,300 tons of titanium dioxide, a year-on-year decrease of 40.46%. Meanwhile, China exported a total of about 1.4983 million tons of titanium dioxide, an increase of 17.14% over the previous year, and the export volume increased by about 2192,000 tons.

The steady increase in export share is beneficial to the new production capacity of titanium dioxide to a certain extent. Combined with the withdrawal of titanium dioxide production capacity in the international market, domestic titanium dioxide exports will continue to rise steadily in the future.

Minsheng Securities Research Report shows that in recent years, domestic titanium dioxide production capacity has expanded rapidly. As prices of titanium ore, energy, etc. continue to rise, overseas giants are rapidly withdrawing from the titanium dioxide market, and domestic product exports have ushered in a period of gold development. In 2023, there were frequent price increase letters in the titanium dioxide industry, compounded by the withdrawal of overseas manufacturers, and industry confidence was boosted. In 2024, the pace of restoration in the domestic paint sector and the fulfillment of expectations for continued growth in overseas exports are worth focusing on.