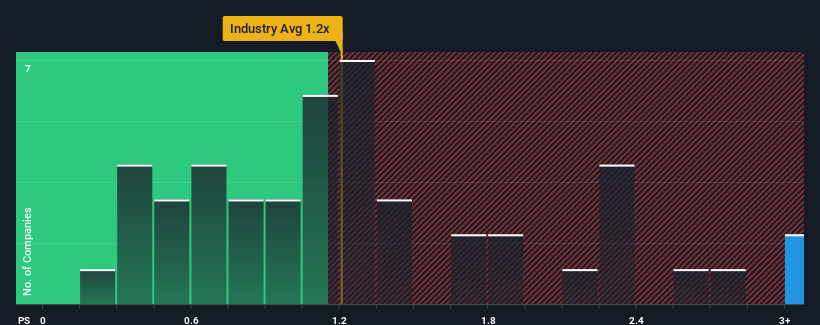

When you see that almost half of the companies in the Oil and Gas industry in China have price-to-sales ratios (or "P/S") below 1.2x, Geo-Jade Petroleum Corporation (SHSE:600759) looks to be giving off strong sell signals with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Geo-Jade Petroleum

How Has Geo-Jade Petroleum Performed Recently?

We'd have to say that with no tangible growth over the last year, Geo-Jade Petroleum's revenue has been unimpressive. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Geo-Jade Petroleum, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Geo-Jade Petroleum's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Geo-Jade Petroleum's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

When compared to the industry's one-year growth forecast of 2.4%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Geo-Jade Petroleum is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Geo-Jade Petroleum revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 2 warning signs for Geo-Jade Petroleum that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.