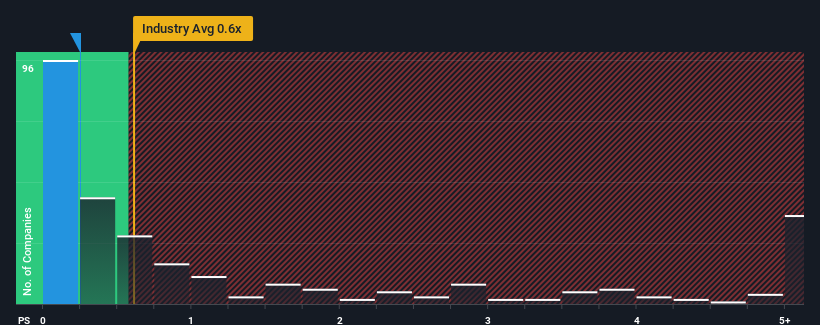

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Real Estate industry in Hong Kong, you could be forgiven for feeling indifferent about Shimao Services Holdings Limited's (HKG:873) P/S ratio of 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Shimao Services Holdings

What Does Shimao Services Holdings' Recent Performance Look Like?

The recently shrinking revenue for Shimao Services Holdings has been in line with the industry. The P/S ratio is probably moderate because investors think the company's revenue trend will continue to follow the rest of the industry. You'd much rather the company improve its revenue if you still believe in the business. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shimao Services Holdings.How Is Shimao Services Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Shimao Services Holdings would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.1%. Even so, admirably revenue has lifted 164% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the five analysts following the company. With the industry predicted to deliver 8.8% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Shimao Services Holdings is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Shimao Services Holdings' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Shimao Services Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Shimao Services Holdings with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.