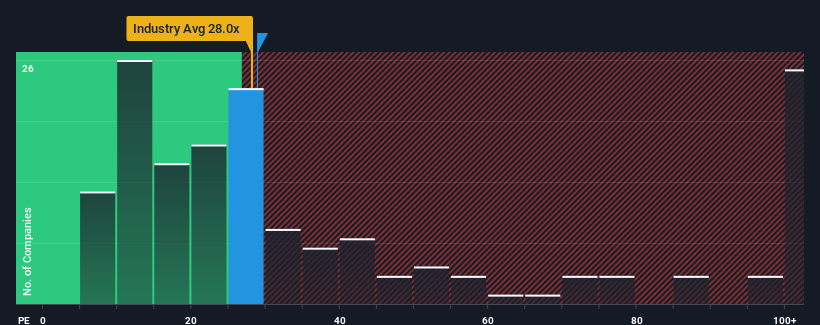

With a price-to-earnings (or "P/E") ratio of 28.8x Pangang Group Vanadium & Titanium Resources Co., Ltd. (SZSE:000629) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 59x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Pangang Group Vanadium & Titanium Resources has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Pangang Group Vanadium & Titanium Resources

Is There Any Growth For Pangang Group Vanadium & Titanium Resources?

There's an inherent assumption that a company should underperform the market for P/E ratios like Pangang Group Vanadium & Titanium Resources' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 359% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 72% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 43%, which is noticeably less attractive.

With this information, we find it odd that Pangang Group Vanadium & Titanium Resources is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Pangang Group Vanadium & Titanium Resources' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for Pangang Group Vanadium & Titanium Resources that you should be aware of.

If you're unsure about the strength of Pangang Group Vanadium & Titanium Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.