[Business Data]

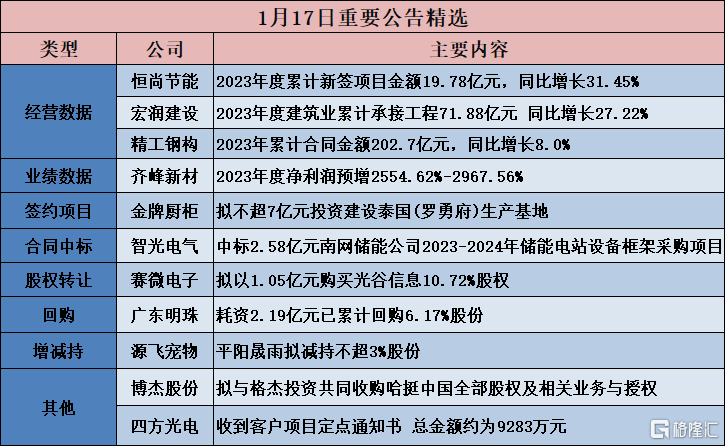

Hengshang Energy Saving (603137.SH): The total amount of newly signed projects in 2023 was 1,978 billion yuan, an increase of 31.45% over the previous year

Hengshang Energy Saving (603137.SH) announced that the total number of new projects signed by the company in 2023 was 58, an increase of 11.54% over the previous year. The cumulative amount of newly signed projects was 1,978 billion yuan, an increase of 31.45% over the previous year. The number of new projects signed by the company in the fourth quarter of 2023 was 13, with a value of 512 million yuan.

Hongrun Construction (002062.SZ): In 2023, the construction industry undertook a total of 7.188 billion yuan of projects, an increase of 27.22% year-on-year

Hongrun Construction (002062.SZ) announced that as of December 31, 2023, the company's construction industry had undertaken a total of 7.188 billion yuan of projects in 2023, an increase of 27.22% over the previous year.

Seiko Steel (600496.SH): cumulative contract amount of 20.07 billion yuan in 2023, an increase of 8.0% year-on-year

Seiko Steel (600496.SH) announced that from January to December 2023, the company (including holding subsidiaries) signed a total of 446 new contracts, with a cumulative contract amount of 20.07 billion yuan, an increase of 8.0% over the previous year; of these, in October-December, the company (including holding subsidiaries) signed a total of 4.16 billion yuan in new contracts, an increase of 0.4% over the previous year. The Philippine project that was recently announced to have won the bid has not yet been signed (see announcement 2023-091 for details), so it is not included in the contract order data in this statistics. From January to December 2023, the company's steel structure sales volume was 1.22 million tons, up 8.9% year on year; of these, steel structure sales in October-December were 318,000 tons, up 2.6% year on year.

Qixia Construction (600533.SH): 2023 commercial housing equity contract sales amount of 3.275 billion yuan

Qixia Construction (600533.SH) announced that from October to December 2023, the company's commercial housing equity contract sales area was 16,200 square meters, and the commercial housing equity contract sales area was 39,900 square meters in the same period last year; the commercial housing equity contract sales amount was 486 million yuan, and the commercial housing equity contract sales amount was 2,361 million yuan in the same period last year. From January to December 2023, the company's commercial housing equity contract sales area was 92,100 square meters, and the commercial housing equity contract sales area for the same period last year was 115,700 square meters; the commercial housing equity contract sales amount was 3.275 billion yuan, and the commercial housing equity contract sales amount for the same period last year was 4.704 billion yuan.

As of December 31, 2023, the total area of the company's rental properties was 88,700 square meters. From October to December 2023, the company confirmed rental property revenue of 1.342,900 yuan, or 11.1763 million yuan for the same period of the previous year; from January to December 2022, the company confirmed rental property revenue of 56.3917 million yuan, compared to 46.987 million yuan for the same period last year.

[Contract project]

Shenghua New Materials (603026.SH): The holding subsidiary plans to invest in the construction of 10,000 tons/year dimethyl sulfoxide project

Shenghua New Materials (603026.SH) announced that Shandong Shenghua Guohong New Materials Co., Ltd., a holding subsidiary of the company, plans to invest in the construction of a 10,000 tons/year dimethyl sulfoxide project. The total investment of the project is estimated at 150 million yuan, 80 million yuan in the first phase and 70 million yuan in the second phase. The construction site is No. 8888, Guohong Avenue, Zoucheng, Jining City, Shandong Province. It covers an area of 13,300 square meters. The construction period of the first phase of the 5,000 tons/year dimethyl sulfoxide project is 18 months. It is expected to be completed and put into operation in June 2025, and the second phase of the 5,000 tons/year dimethyl sulfoxide project will take the opportunity to carry out construction.

Shenghua New Materials (603026.SH): Proposed establishment of a subsidiary to invest in the construction of integrated lithium batteries and green new materials projects

Shenghua New Materials (603026.SH) announced that the company plans to establish a subsidiary, Shandong Shida Chemical Co., Ltd., to invest in the construction of an integrated lithium battery and green new materials project. The construction includes: 1.2 million tons/year alkane dehydrogenation plant and supporting projects, 2 x 100,000 tons/year aniline plant and supporting projects. The total investment of the project was 236.9.97 million yuan, of which the construction investment was 186,8.2054 million yuan, and the working capital was 450.36 million yuan. The investment capital plan for this project will be solved by the company itself.

Hongcheng Environment (600461.SH): It is proposed to establish a joint venture to implement the Nanchang County Sewage Treatment Plant Expansion and Supporting Pipeline Network Franchise Project

Hongcheng Environment (600461.SH) announced that its wholly-owned subsidiary Jiangxi Hongcheng Water Environmental Protection Co., Ltd. and Jiangxi Hongcheng Environmental Construction Engineering Co., Ltd. (“Engineering Company”), Nanchang Municipal Engineering Development Group Co., Ltd. (“Municipal Development”), and China Municipal Engineering Zhongnan Design and Research Institute Co., Ltd. (“Zhongnan Hospital”) jointly established Nanchang County Lianxi Environmental Protection Co., Ltd. The registered capital of the joint venture was RMB 630 million, of which Hongcheng Environmental Protection invested 628.11 million yuan, accounting for 99.7% of the registered capital, the engineering company invested 630,000 yuan, accounting for 0.1% of the registered capital, municipal development invested 630,000 yuan, accounting for 0.1% of the registered capital, and the Central South Hospital invested 630,000 yuan, accounting for 0.1% of the registered capital.

Gold Medal Kitchen Cabinet (603180.SH): It is planned to invest no more than 700 million yuan to build a production base in Thailand (Rayong Province)

Gold Medal Kitchen Cabinet (603180.SH) announced that the company plans to invest in the construction of a production base in Thailand (Rayong Province). The planned investment amount will not exceed RMB 700 million, including but not limited to matters related to the purchase of land, construction of plants and ancillary facilities, and the purchase of machinery and equipment. The company will implement the construction of a production base in Thailand (Rayong Province) in stages according to market demand and business progress.

[Contract won the bid]

Zhiguang Electric (002169.SZ): Subsidiary won 258 million yuan bid for Southern Grid Energy Storage Company's 2023-2024 energy storage power plant equipment framework procurement project

Zhiguang Electronics (002169.SZ) announced that recently, Guangzhou Zhiguang Energy Storage Technology Co., Ltd., a holding subsidiary of Guangzhou Zhiguang Electric Co., Ltd., received a notice of winning the bid. Guangzhou Zhiguang Energy Storage Technology Co., Ltd. won the bid for China Southern Power Grid Energy Storage Co., Ltd.'s 2023-2024 energy storage power plant equipment framework procurement (combined electrical cabin, switch cabin, secondary equipment, communications, battery energy storage system) project (tender number: CG0200022001646055). The winning bid amount was RMB 258 million, accounting for the company's most recent audited revenue 10.97%

Weiming Environmental Protection (603568.SH): Wholly-owned subsidiary signs purchase contract for domestic waste incineration treatment equipment in Indonesia

Weiming Environmental Protection (603568.SH) announced that Weiming Environmental Protection Equipment Group Co., Ltd. (“Weiming Equipment” for short), a wholly-owned subsidiary of the company, and Shanghai Dingxin Investment (Group) Co., Ltd. (“Dingxin Investment”) signed the “Purchase Contract for Domestic Waste Incineration Treatment Equipment at Qingshan Park Development Co., Ltd., the Indonesian Economic and Trade Cooperation Zone Qingshan Park Development Co., Ltd.” in Shanghai. The total contract price including tax is approximately RMB 36.8 million.

[[Share acquisition]

Saiwei Electronics (300456.SZ): Plans to purchase 10.72% of Optics Valley Information's shares for 105 million yuan

Saiwei Electronics (300456.SZ) announced that the company plans to purchase 10.72% of the shares of Wuhan Optics Valley Information Technology Co., Ltd. (“Optics Valley Information” or “Target Company”) held by Xingliao Investment Co., Ltd. (“Xingliao Investment”) and Hubei Xingliao High Investment Network New Media Industry Investment Fund Partnership (Limited Partnership) (“Xingliao Fund”) for 10,5155,700 yuan. After the transaction is completed, the company will hold 23,701,618 shares of Optics Valley Information, accounting for 29.19% of the total share capital of Optics Valley Information. Optics Valley Information will remain the company's participating subsidiary.

Tianli Technology (300399.SZ): Plans to list and transfer 51% of the shares of the holding subsidiary Zhonghe Sihai

Tianli Technology (300399.SZ) announced that in order to further optimize the main business and focus on the main business, Jiangxi Tianli Technology Co., Ltd. plans to transfer 51% of the shares of the holding subsidiary Beijing Zhonghe Sihai Insurance Agency Co., Ltd. (hereinafter referred to as “Zhonghe Sihai” or the “target company”) through public listing at the Jiangxi Property Exchange. The listing reserve price is 2,0381 million yuan (based on assessed value, and considering the impact of debt exemption). If the listing transaction is successful, the company will no longer hold Zhonghe Sihai's shares, and Zhonghe Sihai will no longer be included in the scope of the consolidated statement.

[Performance data]

Lisheng Pharmaceuticals (002393.SZ): 2023 net profit pre-increased 263.2%-305.9%

Lisheng Pharmaceutical (002393.SZ) announced its 2023 annual results forecast. Net profit attributable to shareholders of listed companies during the reporting period was 34,000-380 million yuan, up 263.2%-305.9% over the same period of the previous year; net profit profit after deducting non-recurring profit and loss was 13340-173.4 million yuan, up 7.2%-39.4% over the same period last year; basic earnings per share were 1.84-2.06 yuan/share.

Sanhuan Group (300408.SZ): Expected net profit for 2023 is 1,429 billion yuan to 1,655 billion yuan

Sanhuan Group (300408.SZ) announced its 2023 annual results forecast, with operating income of 5149.3869 million yuan to 617,9264,300 yuan for the reporting period, up 0% to 20% over the same period of the previous year; net profit attributable to shareholders of listed companies was 1424.477 million yuan - 165,51766 million yuan, a change of -5% to 10% over the same period of the previous year; net profit after deducting non-recurring profit and loss of 1037.769 million yuan - 1,306.03 million yuan, a change of -15% to 7% over the same period of the previous year.

Mulinsen (002745.SZ): 2023 net profit pre-increased 120.20%-160.94%

Mulinsen (002745.SZ) announced its 2023 annual results forecast. Net profit attributable to shareholders of listed companies during the reporting period was 427 million yuan to 506 million yuan, an increase of 120.20% to 160.94% over the same period of the previous year; net profit profit after deducting non-recurring profit and loss was 342 million yuan to 404 million yuan, an increase of 120.47% - 160.44% over the same period last year; basic earnings per share were 0.29 yuan/share - 0.34 yuan/share.

Wuxi Zhenhua (605319.SH): 2023 net profit increased 221.33% to 264.59%

Wuxi Zhenhua (605319.SH) announced an announcement of a pre-increase in the 2023 annual results. According to preliminary estimates by the finance department, net profit attributable to shareholders of listed companies is expected to be 260.01 million yuan to 295.0 million yuan in 2023, an increase of 221.33% to 264.59% compared with the same period last year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss is 240.000 million yuan to 28.05 million yuan, an increase of 230.66% to 292.65% compared with the same period last year.

Qifeng New Materials (002521.SZ): 2023 net profit pre-increased by 2554.62%-2967.56%

Qi Feng New Materials (002521.SZ) announced its 2023 annual results forecast. Net profit attributable to shareholders of listed companies during the reporting period was 225 million yuan to 260 million yuan, up 2554.62%-2967.56% over the same period of the previous year; net profit after deducting non-recurring profit and loss of 20 million yuan to 240 million yuan, a loss of 6.355 million yuan for the same period last year; basic earnings per share of 0.45 yuan/share — 0.53 yuan/share.

Guyue Longshan (600059.SH): 2023 net profit pre-increased 94.27% to 105.57%

Guyue Longshan (600059.SH) announced a preliminary increase in its 2023 annual results. According to preliminary estimates by the company's finance department, it is expected to achieve net profit of 392.2 million yuan to 415 million yuan in 2023. Compared with the same period last year, it will increase 19.32 million yuan to 213.12 million yuan, an increase of 94.27% to 105.57% over the previous year. It is expected to achieve net profit of 191.2 million yuan to 196 million yuan after deducting non-recurring profit and loss attributable to the owners of the parent company in 2023. Compared with the same period last year, it will increase by 9.1 million yuan to 13.9 million yuan, an increase of 5.00% to 7.63% over the previous year.

[Repurchase]

Chenghe Technology (688625.SH): A total of 1.268% of the shares have been repurchased at a cost of 63.2448 million yuan

Chenghe Technology (688625.SH) announced that as of January 17, 2024, the company had repurchased a total of 1,716,400 shares through the Shanghai Stock Exchange trading system, accounting for 1.268% of the company's total share capital. The highest repurchase price was 38.70 yuan/share, the lowest price was 35.24 yuan/share, and the total amount paid was RMB 63.2448 million (excluding transaction fees such as stamp duty and transaction commissions).

Guangdong Pearl (600382.SH): A total of 6.17% shares have been repurchased at a cost of 219 million yuan

Guangdong Pearl (600382.SH) announced that as of January 17, 2024, the company had repurchased a total of 474.524 million shares through centralized bidding transactions, accounting for about 6.17% of the company's total share capital of 769,205,771, an increase of 5,415,430 shares compared to the previous disclosure. Up to now, the highest repurchase price is 4.79 yuan/share, the lowest price is 4.41 yuan/share, and the total amount paid is 219 million yuan (not including transaction fees).

[Increase or decrease holdings]

Langte Intelligence (300916.SZ): Controlling shareholders agree to reduce their holdings by no more than 3% in total

Langte Intelligence (300916.SZ) announced that the company recently received a “Notice Letter on the Share Reduction Plan” issued by Huai'an Pengcheng Denggao Investment Partnership (Limited Partnership) (“Pengcheng Denggao”) and Huai'an Pengcheng Denggao Investment Consulting Partnership (Limited Partnership) (“Pengcheng Spreading Wings”), the controlling shareholders of the company. Shareholder Pengcheng Denggao, who holds 18,030,802 shares of the company (accounting for 12.47% of the company's total share capital), and Pengcheng Zhanqi, a shareholder holding 6,513,750 shares (4.50% of the company's total share capital), plans to reduce the total holdings of the company's shares by no more than 4,339,320 shares through centralized bidding or bulk transactions within 3 months after 15 trading days from the date of disclosure of the announcement, that is, the reduction ratio shall not exceed 3% of the company's total share capital.

Yuanfei Pet (001222.SZ): Pingyang Shengyu plans to reduce its shares by no more than 3%

Yuanfei Pet (001222.SZ) announced that the shareholder Pingyang County Shengyu Entrepreneurship Service Center (Limited Partnership), which holds 10,500,000 shares of the company (accounting for 5.50% of the company's total share capital), plans to reduce its holdings of the company's shares by no more than 5,726,700 shares (no more than 3% of the company's total share capital) through centralized bidding transactions or bulk transactions.

[Other]

Sifang Optoelectronics (688665.SH): The total amount of fixed project notifications received from customers is about 92.83 million yuan

Sifang Optoelectronics (688665.SH) announced that the company recently received 2 project fixed-point notices from 2 domestic auto parts companies (according to the confidentiality agreement signed with the above customers, the specific names of the customers cannot be disclosed), confirming that the company will supply them with vehicle-grade PM2.5 sensors and negative ion generators. According to the above customer predictions, the two fixed projects include 1 model platform. The 2 fixed projects will all be delivered starting in 2025, and the total amount is about 92.83 million yuan (tax included).

Bojie Co., Ltd. (002975.SZ): Proposed to jointly acquire all shares of Hating China and related businesses and licenses with Gejie Investment

Bojie Co., Ltd. (002975.SZ) announced that in order to meet the company's high-end manufacturing development needs and actively expand its business layout in the field of industrial parent machines, the company plans to jointly acquire Hating Precision Machinery (Jiaxing) Co., Ltd., Hating Machine Tool (Shanghai) Co., Ltd., and Wanshi (Dalian) Machine Tool Co., Ltd. (hereinafter collectively referred to as “Hating China” or the “Target Company”) with the joint investor Zhuhai Gejie Investment Fund Partnership (“Gejie Investment” or “Joint Investor”) in cash form/The target company collectively refers to the “underlying asset ”, such acquisitions and arrangements are hereinafter referred to as “this transaction”). The transaction price was approximately US$127 million (according to the central price of the US dollar to RMB exchange rate of 1:7.1018 of the China National Administration of Foreign Exchange on November 30, 2023, equivalent to RMB 900 million, depending on whether there were any leaks from the lock box to the delivery date, and the final transaction cost is confirmed at the time of actual delivery). Berger shares and Gejie Investment were acquired according to 70% and 30% investment ratios. After the transaction is completed, the company will hold 70% of Hating China's shares and include Hating China in the scope of the company's consolidated statements.

In order to ensure the smooth implementation of this transaction, according to the “Joint Investment Agreement” signed between the company and Gejie Investment and its subsidiary agreement, the two parties plan to jointly invest RMB 500 million to establish Zhuhai Boda Investment Holdings Co., Ltd. (tentative name, “SPV1”) according to 70% and 30% investment ratios, and SPV1 wholly-owned to establish Zhuhai Boji Investment Holdings Co., Ltd. (tentative name, “SPV2” for short) to finance M&A loans no more than RMB 450 million. The above total amount of RMB 950 million will be exchanged and used to pay consideration for the transaction to the counterparty after deducting expenses related to this transaction and reserving the underlying working capital. After the transaction is completed, SPV2 will directly hold 100% of Hating China's shares.