BlackRock, the world's largest fund management company, agreed to acquire infrastructure investment fund company Global Infrastructure Partners (GIP) for approximately $12.5 billion, thereby becoming one of the top long-term investors in energy, transportation and digital infrastructure.

BlackRock will pay out $3 billion in cash and about 12 million shares worth around $9.5 billion at Thursday's closing level. The deal is expected to close in the third quarter. GIP Chairman and CEO Adebayo Ogunlesi will join BlackRock's board and global executive committee. Ogunlesi was a former Credit Suisse executive

The acquisition of GIP with a management scale of 100 billion US dollars became BlackRock's largest transaction in more than a decade, and also marks a key step for BlackRock CEO Lawrence Fink to become an important player in the rapidly growing private equity and alternative asset markets.

“The demand for digital infrastructure, upgraded logistics centers, and new infrastructure such as decarbonization and energy security is unprecedented. Coupled with a record high government deficit, the demand for private equity capital will also be unprecedented,” Fink and BlackRock President Rob Kapito said in a memorandum to employees. “This will be one of the fastest growing areas in our industry over the next 10 years.”

The company announced the deal on Friday, and also announced a large-scale management restructuring. This is the company's largest acquisition deal since it acquired Barclays Global Investors in 2009. When the GIP agreement was reached, the company reported better-than-expected fourth-quarter earnings, and capital inflows drove its total customer assets to exceed $10 trillion for the first time in two years.

Fink, now 71, founded BlackRock back then because he believes investors, big or small, will choose lower cost index investments in listed companies rather than pay stock selectors. The GIP deal marks a new belief that large institutions will pay higher fees to invest in less liquid funds to invest in large-scale integrated projects.

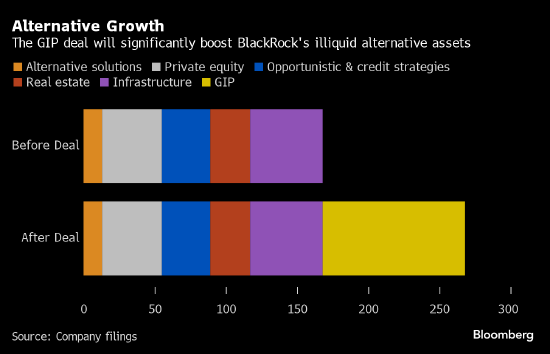

BlackRock also strives to position itself as a one-stop solution for a full range of investment options, including alternative assets. Institutional clients such as pensions, endowments, and sovereign wealth funds are in higher demand for alternative assets. Although alternative investments currently account for about 3% of BlackRock's assets under management, their contribution amounts to about 10% of the costs.

By the end of September, BlackRock had managed infrastructure assets of about 50 billion US dollars. After merging with GIP, its business was comparable to the largest players in the industry, such as Macquarie Asset Management and Brookfield Asset Management (Brookfield Asset Management).

Within the alternative investment market, the infrastructure sector continues to grow. McKinsey predicts that the global infrastructure spending gap will reach $15 trillion by the end of this decade. Helping to fill this gap is expected to bring profit opportunities to investors. GIP is one of the biggest players in this field, holding significant shares in some of the world's busiest airports, such as London Gatwick Airport.

GIP's five founding partners will join BlackRock. About 30% of the shares will be extended for about five years, and BlackRock said it will issue bonds to pay the cash portion. Perella Weinberg Partners advises BlackRock, and Evercore Inc. is GIP's chief advisor.