As the day concludes, John Wiley & Sons (NYSE:WLY) is preparing to distribute a dividend payout of $0.35 per share, resulting in an annualized dividend yield of 4.35%. This payout is exclusive to investors who held the stock before the ex-dividend date on December 26, 2023.

John Wiley & Sons Recent Dividend Payouts

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2023-12-26 | 4$0.35 | 4.35% | 2023-12-14 | 2023-12-27 | 2024-01-11 | |

| 2023-10-06 | 4$0.35 | 3.81% | 2023-09-28 | 2023-10-10 | 2023-10-25 | |

| 2023-07-05 | 4$0.35 | 4.55% | 2023-06-26 | 2023-07-06 | 2023-07-20 | |

| 2023-04-10 | 4$0.35 | 3.76% | 2023-03-29 | 2023-04-11 | 2023-04-25 | |

| 2022-12-23 | 4$0.35 | 3.31% | 2022-12-15 | 2022-12-27 | 2023-01-11 | |

| 2022-10-07 | 4$0.35 | 3.52% | 2022-09-29 | 2022-10-11 | 2022-10-26 | |

| 2022-07-05 | 4$0.35 | 3.02% | 2022-06-23 | 2022-07-06 | 2022-07-20 | |

| 2022-04-04 | 4$0.34 | 2.61% | 2022-03-24 | 2022-04-05 | 2022-04-20 | |

| 2021-12-27 | 4$0.34 | 2.53% | 2021-12-16 | 2021-12-28 | 2022-01-12 | |

| 2021-10-08 | 4$0.34 | 2.59% | 2021-09-30 | 2021-10-12 | 2021-10-27 | |

| 2021-07-02 | 4$0.34 | 2.41% | 2021-06-23 | 2021-07-06 | 2021-07-21 | |

| 2021-04-05 | 4$0.34 | 2.63% | 2021-03-25 | 2021-04-06 | 2021-04-21 |

John Wiley & Sons's dividend yield falls in the middle range when compared to its industry peers, with DallasNews (NASDAQ:DALN) having the highest annualized dividend yield at 14.55%.

Analyzing John Wiley & Sons Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

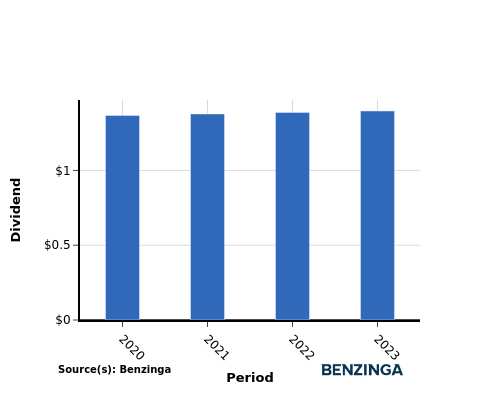

YoY Growth in Dividend Per Share

The company demonstrated a positive dividend growth pattern from 2020 to 2023, with the dividend per share rising from $1.37 to $1.40. This signifies the company's commitment to consistently increasing shareholder dividends.

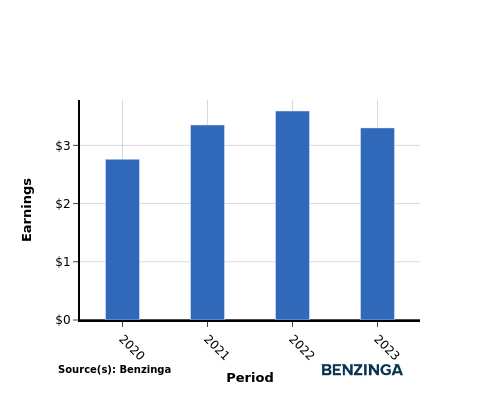

YoY Earnings Growth For John Wiley & Sons

From 2020 to 2023, John Wiley & Sons has demonstrated an upward trend in earnings, with earnings per share rising from $2.76 to $3.30. This positive earnings growth bodes well for investors looking to generate income through cash dividend payouts.

Recap

This article delves into the recent dividend payout of John Wiley & Sons and its implications for shareholders. Presently, the company is distributing a dividend of $0.35 per share, leading to an annualized dividend yield of 4.35%.

John Wiley & Sons's dividend yield falls in the middle range when compared to its industry peers, with DallasNews having the highest annualized dividend yield at 14.55%.

Considering the increase in dividend per share from 2020 to 2023 along with an increase in earnings per share, John Wiley & Sons appears to be in a strong financial position, indicating their ability to sustain dividend distributions to investors.

To stay well-informed about potential changes in financials or dividend disbursements, investors should closely observe the company's performance in the upcoming quarters.

[Monitor live stock price updates for John Wiley & Sons on Benzinga.](John Wiley & Sons (NYSE: WLY))

This article was generated by Benzinga's automated content engine and reviewed by an editor.