David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that China Bester Group Telecom Co., Ltd. (SHSE:603220) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for China Bester Group Telecom

What Is China Bester Group Telecom's Debt?

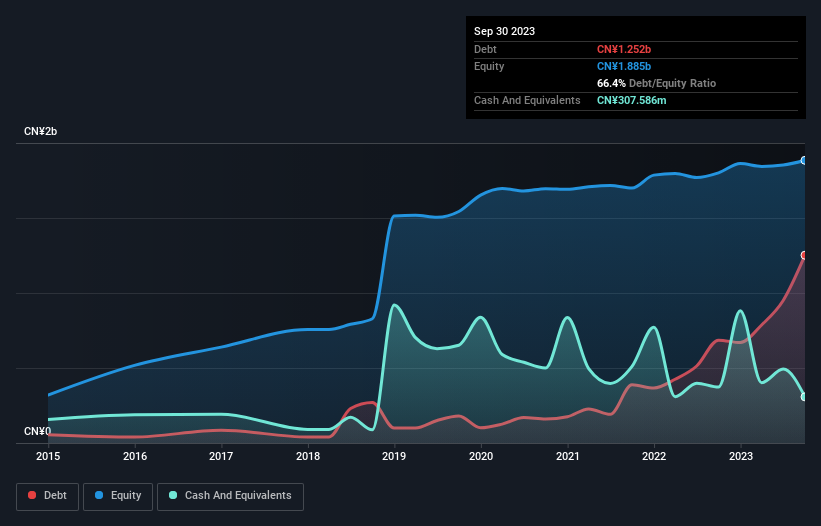

As you can see below, at the end of September 2023, China Bester Group Telecom had CN¥1.25b of debt, up from CN¥685.6m a year ago. Click the image for more detail. However, it also had CN¥307.6m in cash, and so its net debt is CN¥944.3m.

How Strong Is China Bester Group Telecom's Balance Sheet?

According to the last reported balance sheet, China Bester Group Telecom had liabilities of CN¥3.33b due within 12 months, and liabilities of CN¥44.1m due beyond 12 months. Offsetting this, it had CN¥307.6m in cash and CN¥2.47b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥601.0m.

Of course, China Bester Group Telecom has a market capitalization of CN¥10.3b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

China Bester Group Telecom has net debt to EBITDA of 4.5 suggesting it uses a fair bit of leverage to boost returns. But the high interest coverage of 7.1 suggests it can easily service that debt. Unfortunately, China Bester Group Telecom saw its EBIT slide 4.5% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine China Bester Group Telecom's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, China Bester Group Telecom saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

China Bester Group Telecom's struggle to convert EBIT to free cash flow had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example, its interest cover is relatively strong. When we consider all the factors discussed, it seems to us that China Bester Group Telecom is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - China Bester Group Telecom has 3 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.