[Focus on hot topics]

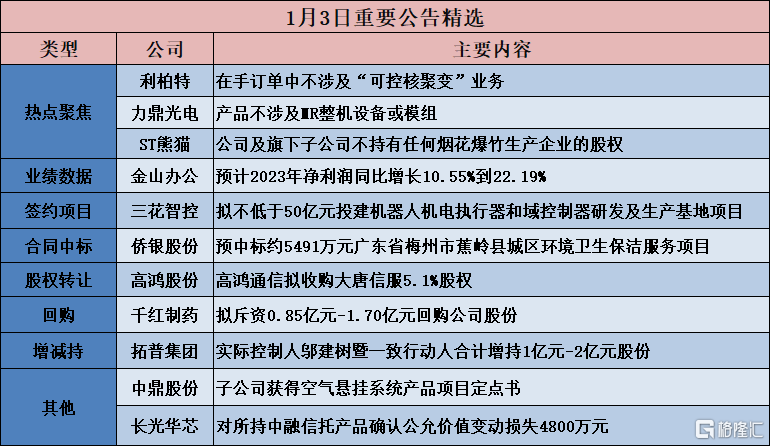

Libert (605167.SH): No “controlled nuclear fusion” business involved in the order

Libert (605167.SH) announced a stock trading risk warning notice. On January 3, 2024, the company's stock price rose and stopped again. It has been rising and stopping for three consecutive trading days, with a cumulative increase of 33.02%, and the cumulative deviation value from the Shanghai Composite Index reached 32.60%. The company is concerned about media and stock rumours, believing that the company has the concept of “controlled nuclear fusion.” The company is mainly engaged in the design and manufacture of industrial modules and engineering services. The company's module products are mainly used in chemical and other industries. As of the disclosure date of this announcement, the company was not involved in the “controlled nuclear fusion” business in the order.

Liding Optoelectronics (605118.SH): The product does not involve MR equipment or modules

Liding Optoelectronics (605118.SH) announced a stock trading risk warning notice. The cumulative closing price increase of the company's stock reached 61.09% for 5 consecutive trading days on December 27, December 28, December 29, and January 2 and January 3, 2024. The short-term increase was significant, but there were no major changes in the company's fundamentals. According to data released by China Securities Index Co., Ltd., as of January 3, 2024, the latest static price-earnings ratio of the company's “C39 computer, communications and other electronic equipment manufacturing industry” was 31.64 times. The company's static price-earnings ratio was 76.31 times, and the company's price-earnings ratio was already higher than the industry's price-earnings ratio.

The company's main business is the design, development, production and sale of optical lenses. Up to now, the company's main business has not changed. The company is concerned about recent media reports that list the company as an MR mixed reality concept sector. The company once again reminds investors that the company's products do not involve MR equipment or modules. The motion capture lenses currently owned by the company are only accessories for MR equipment. They are mainly used to assist terminal customers in combining live motion behavior with virtual scenes during large-scale video shooting. They are not used for household consumer wearable MR equipment products. Currently, shipments of this type of lens product are small, and the impact on the company's revenue is small.

ST Panda (600599.SH): and its subsidiaries do not hold shares in any fireworks manufacturers

ST Panda (600599.SH) announced that up to now, the company and its subsidiaries do not hold shares in any fireworks manufacturer; nor do they hold shares in fireworks and firecrackers wholesale companies in or outside of Hunan Province other than Jiangxi Panda and Hunan Panda.

[Contract project]

Nanxing Co., Ltd. (002757.SZ): It is planned to invest no more than 1.3 billion yuan to build an intelligent equipment production base project

Nanxing Co., Ltd. (002757.SZ) announced that the company held the 18th meeting of the fourth board of directors on January 3, 2024 to review and pass the “Proposal on Proposed Project Investment Agreement”. This bill still needs to be submitted to the company's shareholders' meeting for consideration. In order to further optimize the company's production layout and promote the development of the company's production and operation and the improvement of operating efficiency, the company plans to sign the “Nanxing Intelligent Equipment Production Base Project Investment Agreement” with the Dongguan Houjie Town People's Government to invest in the construction of an intelligent equipment production base project, which will mainly manufacture high-end CNC equipment for home manufacturing such as smart edge banding machines, smart workstations, and intelligent production lines. The total investment of the project is expected to be no more than 1.3 billion yuan, depending on the project construction plan and needs to be invested in instalments.

Sanhua Intelligent Control (002050.SZ): Plans to invest no less than 5 billion yuan to build a robot mechatronic actuator and domain controller R&D and production base project

Sanhua Intelligent Control (002050.SZ) announced that recently, Zhejiang Sanhua Intelligent Control Co., Ltd. and its holding subsidiary Hangzhou Xiantu Electronics Co., Ltd. signed the “Sanhua Intelligent Control Future Industrial Center Project Investment Agreement” with the Hangzhou Qiantang New Area Management Committee. The project consists of two sub-projects, with a total planned investment of not less than 5 billion yuan. Among them: Xiantu Electronics plans to invest in the construction of a Xiantang intelligent inverter controller production base project in Qiantang District, with a total planned investment of not less than 1.2 billion yuan; the company plans to invest in the construction of a robot mechatronic actuator and domain controller R&D and production base project in Qiantang District, with a total planned investment of not less than 3.8 billion yuan.

Longhua New Materials (301149.SZ): Plans to invest about 1.6 billion yuan to build a high-performance modified polymer material project

<投资协议书>Longhua New Materials (301149.SZ) announced that the 11th meeting of the 3rd board of directors and the 11th meeting of the 3rd board of supervisors held on January 3, 2024 respectively reviewed and passed the “Proposal to be Signed”. The company plans to establish a wholly-owned subsidiary with a registered capital of not less than 300 million yuan and invest about RMB 1.6 billion in the Lingang New Area of the China (Shanghai) Pilot Free Trade Zone (hereinafter referred to as “Lingang New Area”) to invest in the construction of a “high-performance modified polymer materials” project and build a polymer materials research and development center.

The project plans to invest a total investment of 1.6 billion yuan, including 1.3 billion yuan in fixed assets. It is proposed to establish a wholly-owned subsidiary Longhua (Shanghai) Polymer Materials Co., Ltd. (name to be registered, subject to the name actually approved by the Industrial and Commercial Registration Department) in the Lingang New Area, to invest in the construction of high-performance modified polymer materials projects, and to build a polymer materials research and development center. The project plans to build a production line with an annual output of 200,000 tons of high-performance modified polymer materials. It mainly produces modified polymer materials including modified nylon series, modified polyester series, and engineered polyolefin series. It is planned to invest in the construction of a research and development center to carry out research and development of high-performance modified polymer materials, nylon 66 polymerization and polyether sectors, and build an integrated R&D and production base.

[Contract won the bid]

Qiaoyin Bank Co., Ltd. (002973.SZ): Pre-bid for an urban environmental hygiene and cleaning service project in Jiaoling County, Meizhou City, Guangdong Province

Qiaoyin Bank Co., Ltd. (002973.SZ) announced that recently, Qiaoyin City Management Co., Ltd. won the bid for the Jiaoling County Urban Environmental Hygiene and Cleaning Service Project. The winning bid (transaction) amount was approximately 54.911,700 yuan/3 years.

University of Technology Hi-Tech (688367.SH): won the bid for 154 million yuan scenic area renovation and upgrading project

Polytechnic University Hi-Tech (688367.SH) announced that the company recently received a “Transaction Notice” for the “Qinghai Chaka Salt Lake Cultural Tourism Development Co., Ltd. Scenic Area Renovation and Upgrading Project EPC”. The project control price is RMB 154 million (tax included; the specific amount is subject to settlement audit). The company is responsible for the overall management, signal and electricity engineering of the winning project, and the final amount involved will be subject to the duly signed contract.

Nanwei Software (603636.SH): won the bid of 156 million yuan for the Quanzhou Public Security Bureau to improve and upgrade the urban safety information system (2023) project

Nanwei Software (603636.SH) announced that on January 3, 2024, the Fujian Public Resources Exchange Electronic Public Service Platform announced the winning bid results for the Quanzhou Public Security Bureau's project to improve and upgrade the Urban Safety Information System (2023) (“this project” for short). The company was the winning bidder for the project, with a bid amount of 156 million yuan.

[[Share acquisition]

Gaohong Co., Ltd. (000851.SZ): Gaohong Communications plans to acquire 5.1% of Datang Xinfu's shares

Gaohong Co., Ltd. (000851.SZ) announced that Datang Gaohong Communication Technology Co., Ltd. (“Gaohong Communications”), a wholly-owned subsidiary of the company, intends to acquire 5.1% of the shares of the participating company Datang Xinfu Technology Co., Ltd. (Datang Xinfu) from Datang Fusion Communications Co., Ltd. (abbreviation: Datang Fusion). The specific transfer price has not yet been determined. After the evaluation is completed, the company will carry out the necessary approval procedures.

Jinbei Auto (600609.SH): Transfer 51% of Shanghai Minfu's shares for 4 million yuan

Jinbei Auto (600609.SH) announced that on January 3, 2024, the company's subsidiary Jinchen Auto signed an “Equity Transfer Agreement” with Guannan Trading. The transaction amount was 4 million yuan. The contract officially came into effect on the date of signing. Shanghai Minfu is a company controlled by Shenyang Jinchen Automobile Technology Development Co., Ltd., a subsidiary of the company. After the transfer, the scope of the company's consolidated statements will change. Transferring 51% of Shanghai Minfu's shares will help the company to return funds in a timely manner, provide more resources for optimizing the company's business structure, and continuously enhance the company's value; it is also conducive to better safeguarding the interests of the company and all shareholders. According to the company's preliminary estimates, the share transfer was completed at 4 million yuan, which is not expected to have a significant impact on the company's performance.

[Performance data]

Central Control Technology (688777.SH): Net profit forecast to increase 25.32% to 44.12% in 2023

China Control Technology (688777.SH) announced its 2023 annual results forecast. According to preliminary estimates by the finance department, it is expected to achieve operating income of 796,0000 million yuan to 928,0000 million yuan in 2023. Compared with the same period of the previous year (statutory disclosure data), it will increase by 1336.1435 million yuan to 2656.1435 million yuan, an increase of 20.17% to 40.10% over the previous year.

The net profit attributable to the owners of the parent company is expected to be RMB 1,000,000 to RMB 1,150,000 in 2023. Compared with the same period of the previous year (statutory disclosure data), it will increase by RMB 20.070,800 to RMB 352.070,800, an increase of 25.32% to 44.12% over the previous year. Net profit attributable to the owner of the parent company after deducting non-recurring profits and losses is expected to be 840,000 yuan to 97.0000 million yuan in 2023. Compared with the same period of the previous year (statutory disclosure data), it will increase by 156.9844 million yuan to 286.9844 million yuan, an increase of 22.98% to 42.02% over the previous year.

Jinshan Office (688111.SH): Net profit is expected to increase 10.55% to 22.19% year-on-year in 2023

Jinshan Office (688111.SH) announced that according to preliminary estimates by the finance department, it is expected to achieve operating income of 4368.58 million yuan to 4794.59 million yuan in 2023. Compared with the same period last year, it will increase 483.62 million yuan to 909.63 million yuan, an increase of 12.45% to 23.41% over the previous year. The net profit attributable to the owner of the parent company is expected to be 1,235.47 million yuan in 2023. Compared with the same period last year, it will increase by 117.94 million yuan to 247.98 million yuan, an increase of 10.55% to 22.19% over the previous year. It is expected to achieve net profit of 1,178 million yuan to 1,302 million yuan after deducting non-recurring profit and loss attributable to the owners of the parent company in 2023. Compared with the same period last year, it will increase by 239.15 million yuan to 363.15 million yuan, an increase of 25.47% to 38.68% over the previous year.

Zhongke Blue News (688332.SH): Net profit forecast to increase 70.34% to 84.53% in 2023

Zhongke Blue News (688332.SH) announced the advance announcement of the 2023 annual results. According to preliminary estimates by the finance department, the company is expected to achieve operating income of 143,0000 million yuan to 1450 million yuan in 2023. Compared with the same period of the previous year (statutory disclosure data), it will increase 350.99 million yuan to 37.0099 million yuan, an increase of 32.42% to 34.27% over the previous year. Net profit attributable to owners of the parent company in 2023 was RMB 240,000 to RMB 260.01 million. Compared with the same period of the previous year (statutory disclosure data), it will increase by RMB 99.103 million to RMB 119.103 million, an increase of 70.34% to 84.53% over the previous year. Net profit attributable to the owners of the parent company in 2023, after deducting non-recurring profit and loss, will increase by 47.854,400 yuan to 67.854 million yuan compared with the same period last year (statutory disclosure data), an increase of 42.67% to 60.51% over the previous year.

[Repurchase]

Qianhong Pharmaceutical (002550.SZ): Plans to spend 85 million yuan to 170 million yuan to buy back the company's shares

Qianhong Pharmaceutical (002550.SZ) announced an announcement regarding the plan to repurchase the company's shares. The total repurchase amount is not less than RMB 85 million (inclusive) and not more than RMB 170 million (inclusive). The price of the repurchased shares is no more than RMB 6.8 per share (inclusive), and the maximum price of the repurchased shares does not exceed 150% of the average trading price of the company's shares on the 30 trading days before the board of directors passed the share repurchase resolution.

[Increase or decrease holdings]

Chenfeng Technology (603685.SH): Hangzhou Hongwo plans to reduce its holdings by no more than 1%

Chenfeng Technology (603685.SH) announced that within 3 months after 15 trading days from the date of publication of this announcement, Hangzhou Hongwo reduced its holdings of the company's shares by no more than 1.69 million shares through centralized bidding transactions on the stock exchange, that is, no more than 1% of the company's total shares. Furthermore, within any 90 consecutive days, the total number of reduced shares shall not exceed 1% of the total number of shares of the company. The holdings reduction price is determined based on the market price.

Tuopu Group (601689.SH): The actual controller Wu Jianshu and the concerted actors increased their total holdings by 100 million yuan to 200 million yuan

Tuopu Group (601689.SH) announced that on January 3, 2024, Ningbo Tuopu Group Co., Ltd. received a notice from Mr. Wu Jianshu, the chairman and actual controller of the company, and Paishe Real Estate, the controlling shareholder of the company. Mr. Wu Jianshu and Paishe Real Estate increased their holdings of some of the company's shares through the centralized bidding system of the Shanghai Stock Exchange and plan to continue to increase their holdings for 6 months from the date of the increase in holdings. On January 3, 2024, Mr. Wu Jianshu increased his holdings of the company's shares by 655,200 shares through the centralized bidding system of the Shanghai Stock Exchange, accounting for 0.06% of the company's total shares. The transaction amount was 45,016,519.20 yuan, and the average transaction price was 68.71 yuan/share. Paishe Real Estate increased its shareholding by 850,400 shares through the Shanghai Stock Exchange centralized bidding system, accounting for 0.08% of the company's total shares. The transaction amount was 58,370,423.44 yuan, and the average transaction price was 68.64 yuan/share. The total amount of the main plan to increase holdings is not less than RMB 100 million and not more than RMB 200 million (including the portion already increased).

Dabeinong (002385.SZ): Vice Chairman and his co-actors increased their holdings by 1 million shares in total

Dabeinong (002385.SZ) announced that the company recently received a notice from Mr. Zhang Lizhong, vice chairman of the company, and Ms. Wang Lina. Based on their confidence in the company's future development prospects and recognition of the company's value, Mr. Zhang Lizhong and his co-actor, Ms. Wang Lina each increased their holdings of the company's shares by 500,000 shares through centralized bidding transactions on January 2, 2024 through the Shenzhen Stock Exchange trading system, for a total increase of 1 million shares, accounting for 0.02% of the company's total share capital.

[Other]

Zhongding Co., Ltd. (000887.SZ): The subsidiary obtained the Air Suspension System Product Project Designation Letter

Zhongding Co., Ltd. (000887.SZ) announced that its subsidiary AMK Holding GmbH & Co.KG (“AMK Company”), a Chinese subsidiary, Amico (Anhui) Automotive Electric Drive Co., Ltd. (“Anhui Amico”) recently received a customer notice that the company has become a leading domestic independent brand OEM (limited to a confidentiality agreement, unable to disclose its name, “customer”) as a batch supplier of air supply unit assembly products for the new platform project. The life cycle of this project is 5 years, and the total life cycle amount is about 340 million yuan.

Changguang Huaxin (688048.SH): Confirmed a fair value change loss of 48 million yuan for its China Finance Trust products

Changguang Huaxin (688048.SH) announced that in order to improve the efficiency of the use of the company's temporarily idle own funds, better preserve and increase the value of the company's idle own funds, and increase the company's profits. Without affecting normal production and operation, the company purchased the trust wealth management products of China Finance International Trust Co., Ltd. with its own funds. The product name is “Zhongrong-Longsheng No. 1 Pooled Fund Trust Plan”. The purchase amount is RMB 60 million, the expected annualized yield is 6.6%, and the risk level is R3 medium risk (no guarantee of capital guarantee and minimum return, with certain investment risk). The trust plan lasts for a total of 358 days from the subscription date, and the expiration date is December 27, 2023. As of the disclosure date of this announcement, the principal amount and investment income of this trust product have not been recovered. Other than the above trust products, the company did not purchase any other related wealth management products of China Finance International Trust Co., Ltd.

On the trading day, the company recognized the “Zhongrong-Longsheng No. 1 Pooled Fund Trust Plan” as a financial asset measured at fair value and its changes included in the current profit and loss in accordance with “Enterprise Accounting Standard No. 22 - Financial Instrument Verification and Measurement”, reported it in the “Transactional Financial Assets” category, and confirmed the initial investment cost of 60 million yuan. In view of China Finance Trust's current major financial difficulties, as of the disclosure date of this announcement, the product has been overdue and has not been paid, and there is a risk that the principal and interest will not be fully paid. In order to objectively, fairly, and accurately reflect the company's asset value and financial situation, based on the principle of prudence, the company decided to confirm a fair value change loss of 48 million yuan for the trust product it holds.