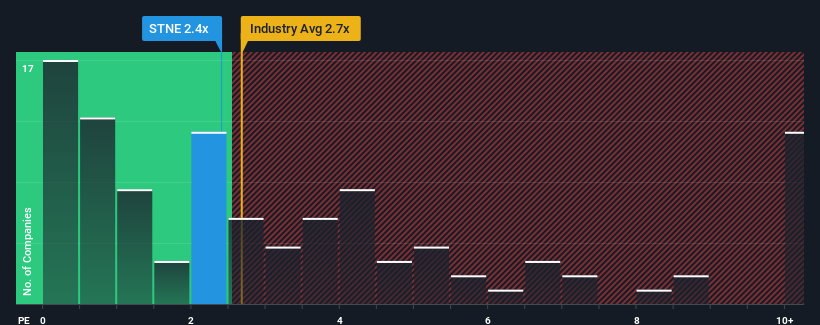

With a median price-to-sales (or "P/S") ratio of close to 2.7x in the Diversified Financial industry in the United States, you could be forgiven for feeling indifferent about StoneCo Ltd.'s (NASDAQ:STNE) P/S ratio of 2.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for StoneCo

What Does StoneCo's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, StoneCo has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on StoneCo.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, StoneCo would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. The strong recent performance means it was also able to grow revenue by 279% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.8% per annum during the coming three years according to the analysts following the company. That's shaping up to be similar to the 9.0% per annum growth forecast for the broader industry.

In light of this, it's understandable that StoneCo's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A StoneCo's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Diversified Financial industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for StoneCo with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.