[Focus on hot topics]

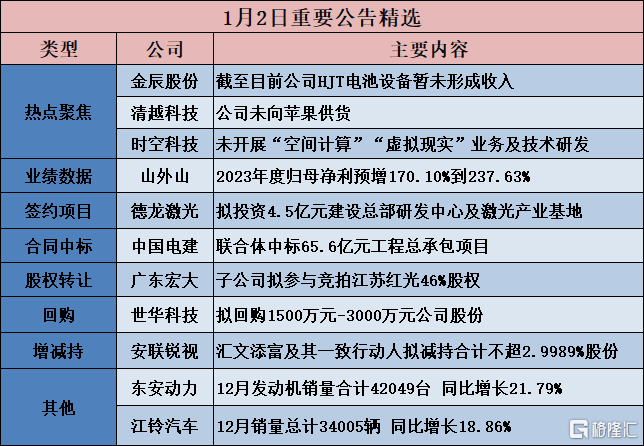

Jinchen Co., Ltd. (603396.SH): Up to now, the company's HJT battery equipment has not generated revenue

Jinchen Co., Ltd. (603396.SH) announced abnormal fluctuations in stock trading. Currently, the company's main products are complete equipment for automated production lines for solar photovoltaic modules and solar photovoltaic cell manufacturing equipment. According to media reports, the company is involved in the HJT battery concept. Up to now, the company's HJT battery equipment has not generated revenue. According to the company's own inspection, all of the company's daily business activities are normal, and there have been no major adjustments in the market environment or industry policies. There are no important matters affecting abnormal stock price fluctuations that should be disclosed but not disclosed in the company's production and operation.

Qingyue Technology (688496.SH): The company did not supply to Apple

Qingyue Technology (688496.SH) announced an announcement of abnormal fluctuations in stock trading. Recently, the MR headset market has received widespread attention. It is hereby explained that the company is not supplying Apple. In the first three quarters of 2023, the company's silicon-based OLED business revenue was 8.152,000 yuan (data unaudited), accounting for 1.5% of overall revenue, which is a low proportion. The company has a mass production line for 8-inch silicon-based OLED displays, but the yield and production capacity of the production line are still in the early stages of mass production, and it will take a long time to fully reach production.

Kechuan Technology (603052.SH): It does not directly produce MR equipment. It has developed one of the chip process protective functional films to support the production of MR equipment

Kechuan Technology (603052.SH) announced an announcement of abnormal fluctuations in stock trading. The company paid attention to media reports related to the MR product concept. The company does not directly produce MR equipment; one of the chip process protective films developed by the company supports the production of MR equipment. The operating income and profit of chip process protective film products in 2023 is relatively small, less than 5%, and will not have a significant impact on the company's operating performance.

Liding Optoelectronics (605118.SH): The company's products do not involve MR equipment or modules. The motion capture lenses currently owned by the company are only accessories for MR equipment

Liding Optoelectronics (605118.SH) announced abnormal stock trading fluctuations and risk warning announcements. The company is concerned about recent media reports that the company is listed as an MR mixed reality concept section. The company reminds investors that the company's products do not involve MR equipment or modules. The motion capture lenses currently owned by the company are only accessories for MR equipment. They are mainly used to assist end customers to combine live motion behavior with virtual scenes during large-scale video shooting. It is not used for consumer grade wearable MR device products for home use. Currently, shipments of this type of lens product are small. Right The impact on the company's revenue is small.

Spatio-temporal Technology (605178.SH): No “spatial computing” or “virtual reality” business and technology research and development

Time Space Technology (605178.SH) issued a stock trading risk warning notice. The company is concerned about media and stock bar rumors, believing that the company has the concepts of “spatial computing” and “virtual reality”. Up to now, the company has not carried out “spatial computing” and “virtual reality” business or technology research and development involving hot topics, nor does it have the corresponding personnel, capital and technical reserves. It is hereby explained. The company's current production and operation conditions are normal, there have been no major changes in the internal and external business environment, and there is no other important information that should be disclosed but not disclosed.

[Contract project]

Huafu Fashion (002042.SZ): The subsidiary plans to invest in the “Shangyu Huashang Digital Intelligence Center AIGC Intelligent Computing Center Project”

Huafu Fashion (002042.SZ) announced that Zhejiang Huafu Textile Co., Ltd., a wholly-owned subsidiary of the company, plans to invest in the “Shangyu Huashang Digital Intelligence Center AIGC Intelligent Computing Center Project”. The planned construction scale of the project is 3000 PFLOPS of AI computing power, and the estimated investment amount for the first phase of the project is 250 million yuan.

Yuxin Co., Ltd. (002986.SZ): The holding subsidiary plans to invest about 1.08 billion yuan to build the second phase of the light hydrocarbon comprehensive utilization project

Yuxin Co., Ltd. (002986.SZ) announced that on November 3, 2020, the company signed the “Investment Agreement for the Yuxin Light Hydrocarbon Comprehensive Utilization Project” with the Huizhou Huizhou Huandaya Bay New Area Management Committee and the Huidong County People's Government to invest in the construction of the light hydrocarbon comprehensive utilization project through the holding subsidiary Huizhou Broke Environmental New Materials Co., Ltd. (hereinafter referred to as “Brocade Environmental Protection”). Currently, the first phase of the light hydrocarbon comprehensive utilization project is being carried out in an orderly manner. In order to optimize and improve the company's carbon 4 deep processing industry chain, it is proposed to build the second phase of the light hydrocarbon comprehensive utilization project through investment from Brocade Environmental Protection.

The total planned investment (tax included) of the project is 1,108 billion yuan, including: construction investment of 86.034 million yuan, financing expenses during the construction period of 27.29 million yuan, value-added tax of 94.83 million yuan, and working capital of 125.51 million yuan. 30% of the project's funding sources are the company's own funds, and 70% are bank loans. The project includes a 550,000 tons/year isobutane dehydrogenation unit, 1.05 million tons/year mixed alcohol ether unit, and supporting public works and auxiliary facilities. The construction period of the project is 19 months. Construction is scheduled to begin in January 2024, and is expected to be completed and put into operation by July 2025.

Delong Laser (688170.SH): Plans to invest 450 million yuan to build a headquarters R&D center and laser industry base

Delong Laser (688170.SH) announced that the company plans to build a Delong Laser headquarters R&D center and laser industry base in Suzhou Industrial Park. Related products include lasers, optical inspection systems, optical modules, and new energy hydrogen energy intelligent equipment, etc., with a proposed investment scale of 450 million yuan (the laser industrialization project in this project plans to use raised capital of 130.2368 million yuan to invest in construction, and the headquarters R&D center construction project plans to use raised capital of 42.561 million yuan to invest in construction; the rest will use its own or self-funded investment for construction), Suzhou Industrial Park to invest in construction The company provided a total area of about 30 acres of industrial land for project construction. After purchasing the plot, the company will sign the “Suzhou Industrial Park Investment and Development Supervision Agreement” with the authorized department of Suzhou Industrial Park. This investment is in line with the company's future strategic layout, meets the company's business development needs, and helps accelerate the improvement of supporting production capacity and enhance the company's core competitiveness.

Zhongyuan Internal Distribution (002448.SZ): Plans to invest no more than 210 million yuan to build a new production base in Thailand

Zhongyuan Internal Distribution (002448.SZ) announced that in order to optimize the strategic layout and enhance market competitiveness, Zhongyuan Internal Distribution Group Co., Ltd. plans to invest in a new production base in Thailand to implement the national “Belt and Road” initiative, while also meeting the company's future business development and overseas market expansion needs. The planned investment amount for the project does not exceed RMB 210 million, including but not limited to matters related to land purchase and construction of fixed assets. The actual investment amount is based on the amount approved by China and local authorities. The company will implement the construction of a production base in Thailand in stages according to specific conditions such as market demand and business progress. This investment project is the company's main business.

Jiaocheng Ultrasound (688392.SH): Plans to invest no less than 650 million yuan to build a headquarters base and advanced ultrasound equipment industrialization project

Jiaocheng Ultrasound (688392.SH) announced that the company plans to sign an investment agreement with the DazeroBay Science and Technology Innovation Strategy Functional Zone Management Committee Office to invest in the construction of Jiaocheng Ultrasound headquarters base and advanced ultrasound equipment industrialization projects. The total planned investment of the project is not less than RMB 650 million.

[Contract won]

China Power Construction (601669.SH): The consortium won the bid for the 6.56 billion yuan general contracting project

China Power Construction (601669.SH) announced that its subsidiary China Power Construction Ecological Environment Group Co., Ltd. and China Power Construction Group East China Survey and Design Research Institute Co., Ltd., China Power Construction Group Northwest Survey and Design Research Institute Co., Ltd., China Power Construction Group Zhongnan Survey and Design Research Institute Co., Ltd., China Water Resources and Hydropower Seventh Engineering Bureau Co., Ltd., China Water Resources and Hydropower 11th Engineering Bureau Co., Ltd., and China Power Construction Municipal Construction Group Co., Ltd. formed a consortium to win the bid for the Shunde District Nanshun 2nd Joint Comprehensive Water Treatment Project and Shunde District The winning bid amount for the Guishui Water System Comprehensive Water Environment Treatment Project (EPC) project was approximately RMB 6.56 billion. The construction content of this project includes water pollution prevention and control projects (including drainage unit rain and sewage diversion renovation projects, municipal sewage network improvement projects, stock pipe network renovation projects, internal flooding risk point remediation projects), water environment treatment projects (including river chong dredging projects, hidden wall remediation projects), hydrodynamic construction projects (including water system connection projects, inland river control and locking projects), aquatic ecological restoration projects (including small and micro water body lifting projects, not including environmental remediation projects along the river coastline, ecological space treatment projects along the river)), intelligent water management and control engineering, etc. The contract period is tentatively set for 36 months.

Jida Communications (300597.SZ): Pre-bid for tenders totaling RMB 82.9817 million

Jida Communications (300597.SZ) announced that recently, China Unicom Procurement and Bidding Network has successively released the “2024-2025 China Unicom Jilin Branch Songyuan and Baicheng Regional Wireless Professional Hongzhan Construction Centralized Procurement Public Bidding Project - Announcement of Successful Candidates” and “2024-2025 China Unicom Jilin Branch Connected to Professional Construction Public Bidding Centralized Procurement - Announcement of Successful Candidates”. Jilin Changyou Communications Construction Co., Ltd., a wholly-owned subsidiary of Jilin Jida Communications Design Institute Co., Ltd., was one of the successful candidates for the tender project. It is estimated that the total amount of the bid, including tax, will be 82.9817 million yuan.

Tianyi Co., Ltd. (300504.SZ): Pre-winning the bid for the China Telecom Digital Repeater (2023) centralized procurement project of about 29.76 million yuan

Tianyi Co., Ltd. (300504.SZ) announced that recently, the company received a “Notice of Winning Bid” and determined that the company was the winner of the China Telecom Digital Repeater (2023) centralized procurement project. The estimated bid amount is about 29.76 million yuan (tax included).

[[Share acquisition]

Guangdong Hongda (002683.SZ): The subsidiary plans to participate in the auction for 46% of Jiangsu Hongguang's shares

Guangdong Hongda (002683.SZ) announced that Guangdong Minghua Machinery Co., Ltd. (now renamed “Guangdong Hongda Defense Technology Co., Ltd.”, “Hongda Defense Technology” or “Minghua Company”), a holding subsidiary of the company, intends to acquire 46% of the shares of Jiangsu Hongguang Chemical Co., Ltd. (“Shandong Tianbao”) held by Shandong Tianbao Chemical Co., Ltd. (“Shandong Tianbao”) by participating in the auction. The final amount is determined from the auction results, and there is some uncertainty as to whether the deal can be reached.

[Performance data]

Dalian Heavy Industries (002204.SZ): 2023 net profit pre-increased 17.98%-31.87%

Dalian Heavy Industries (002204.SZ) announced its 2023 annual results forecast. Net profit attributable to shareholders of listed companies during the reporting period was 340 million yuan to 380 million yuan, an increase of 17.98%-31.87% over the same period of the previous year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 198 million yuan - 238 million yuan, an increase of 1.25%-21.71% over the same period last year; basic earnings per share were 0.1,760 yuan/share - 0.1968 yuan/share. In 2023, the company's revenue is expected to reach about 12 billion yuan, an increase of about 15.80% over the previous year, driving the company's overall gross profit increase. Among them, the gross profit of mainly new energy equipment products and engineering turnkey projects increased significantly year-on-year.

Mountain Wai Shan (688410.SH): Net profit to mother increased by 170.10% to 237.63% in 2023

Shanwai Mountain (688410.SH) announced its 2023 annual results forecast. It is expected to achieve operating revenue of 65.0 million yuan to 720.00 million yuan in 2023. Compared with the same period last year (statutory disclosure data), it will increase 267.9873 million yuan to 337.9873 million yuan, an increase of 70.15% to 88.48% year-on-year.

The net profit attributable to the owners of the parent company is expected to be RMB 16.0000 million to RMB 200,000 in 2023. Compared with the same period of the previous year (statutory disclosure data), it will increase by RMB 10,0763 million to RMB 1407.63 million, an increase of 170.10% to 237.63% over the previous year. Net profit attributable to owners of the parent company in 2023 after deducting non-recurring profit and loss is estimated to be 140.00 million yuan to 175.0 million yuan. Compared with the same period of the previous year (statutory disclosure data), it will increase by 917.405 million yuan to 126.7405 million yuan, an increase of 190.10% to 262.62% over the previous year.

During the reporting period, the company continuously enhanced its competitive advantage through measures such as technological innovation, new product layout, and performance improvement, and was fully recognized by customers, and the brand effect was gradually enhanced to achieve product sales growth; through continuous optimization of key process technology and management processes, the release of large-scale effects led to cost reduction and efficiency in manufacturing; and with the launch of new blood purification consumables, continuous blood purification pipelines, hemodialyzers, and single-use hemoperfusion devices, product sales synergy benefits were strengthened. With the further promotion of domestic replacement policies for blood purification products, the company's operating income and profit level continued to grow.

[Repurchase]

Shihua Technology (688093.SH): Plans to repurchase 15 million yuan to 30 million yuan of company shares

Shihua Technology (688093.SH) announced that the total capital to be repurchased will not be less than RMB 15 million, not more than RMB 30 million, and that the share repurchase price will not exceed RMB 26 per share.

Donga Ejiao (000423.SZ): Proposed to repurchase 1,512,300 shares to 1.66 million shares of the company

Donga Ejiao (000423.SZ) announced an announcement on a plan to repurchase the company's shares through centralized bidding transactions. The minimum number of shares to be repurchased is 1,5123.32 million shares (inclusive), and the upper limit is 1.66 million shares (inclusive); the repurchase price does not exceed RMB 74.82 per share (inclusive), which is no higher than 150% of the average trading price of the company's shares over the 30 trading days before the board of directors passes the buyback resolution; the repurchase period shall not exceed 12 months from the date the board of directors reviews and approves the share repurchase plan; the share incentive plan is implemented for repurchase purposes.

[Increase or decrease holdings]

China Mobile (600941.SH): China Mobile Group's plan to increase the company's A-share holdings by a total of 42.367 million shares has been implemented

China Mobile (600941.SH) announced that from January 21, 2022 to December 29, 2023, China Mobile Group increased its holdings of 42.367 million A-shares through the Shanghai Stock Exchange trading system, accounting for 0.198% of the company's total issued shares and 4.693% of the total number of A-shares issued by the company, with a cumulative increase of 3 billion yuan (excluding commissions and transaction taxes).

Allianz Vision (301042.SZ): Huiwen Tianfu and its co-actors plan to reduce their total holdings by no more than 2.9989%

Allianz Reishi (301042.SZ) announced that Huiwen Tianfu, a shareholder holding 5% or more of the shares, and Qi Liang, plan to reduce their total holdings of the company's shares by no more than 2,080,000 shares (2.9989% of the company's total share capital) by means of centralized bidding transactions and/or 3 months after the date of disclosure of the announcement within 3 months after the date of disclosure of the announcement.

Nippon Broadcasting Fashion (603196.SH): Hu Bojun plans to reduce his shareholding by no more than 1%

Nippon Broadcasting Fashion (603196.SH) announced that Mr. Hu Bojun plans to reduce his holdings by no more than 1.0000% of the company's total share capital, or 2,386,806 shares, through centralized bidding transactions. The reason for the reduction in holdings was due to personal capital requirements, and the price of the holdings reduction was determined according to the market price.

[Other]

Jiangling Motors (000550.SZ): Total sales volume in December was 3,4005 vehicles, up 18.86% year-on-year

Jiangling Motors (000550.SZ) announced production and sales for December 2023. Total sales volume in December was 34,005 vehicles, up 18.86% year on year. The cumulative sales volume for January-December was 310,008 vehicles, up 9.93% year-on-year.

Dongan Power (600178.SH): Total engine sales volume of 42,049 units in December increased 21.79% year over year

Dongan Power (600178.SH) released the December production and sales data report. Total engine sales volume was 4,2049 units, up 21.79% year on year, and total transmission sales volume was 13,982 units, up 277.99% year on year.