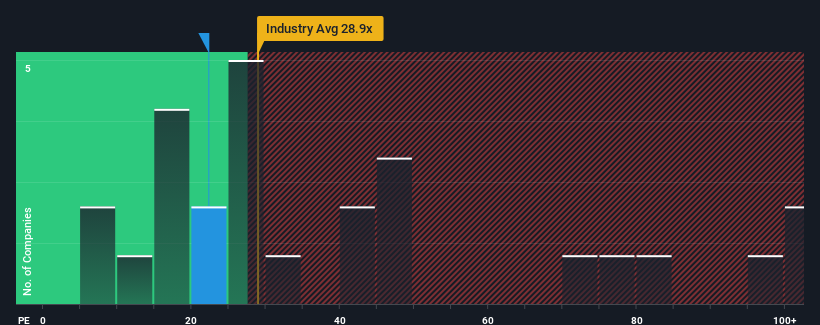

Zhejiang China Commodities City Group Co., Ltd.'s (SHSE:600415) price-to-earnings (or "P/E") ratio of 22.3x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 36x and even P/E's above 65x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

The recently shrinking earnings for Zhejiang China Commodities City Group have been in line with the market. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Zhejiang China Commodities City Group

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Zhejiang China Commodities City Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.4%. Still, the latest three year period has seen an excellent 37% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 52% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 44%, which is noticeably less attractive.

In light of this, it's peculiar that Zhejiang China Commodities City Group's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Zhejiang China Commodities City Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Zhejiang China Commodities City Group you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.