Opendoor Technologies Inc. (NASDAQ:OPEN) shares have continued their recent momentum with a 49% gain in the last month alone. The last month tops off a massive increase of 286% in the last year.

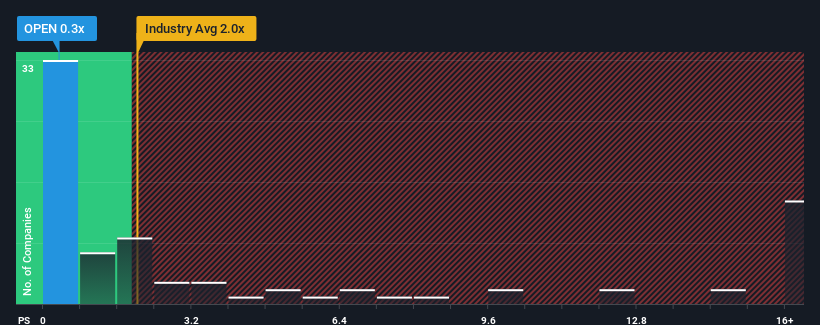

In spite of the firm bounce in price, Opendoor Technologies' price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Real Estate industry in the United States, where around half of the companies have P/S ratios above 2x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Opendoor Technologies

What Does Opendoor Technologies' P/S Mean For Shareholders?

Opendoor Technologies hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Opendoor Technologies will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Opendoor Technologies?

The only time you'd be truly comfortable seeing a P/S as low as Opendoor Technologies' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 46% decrease to the company's top line. Still, the latest three year period has seen an excellent 149% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 8.0% per year as estimated by the eleven analysts watching the company. With the industry predicted to deliver 11% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Opendoor Technologies' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Opendoor Technologies' P/S?

The latest share price surge wasn't enough to lift Opendoor Technologies' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Opendoor Technologies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 6 warning signs for Opendoor Technologies you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.