Despite an already strong run, Personalis, Inc. (NASDAQ:PSNL) shares have been powering on, with a gain of 42% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

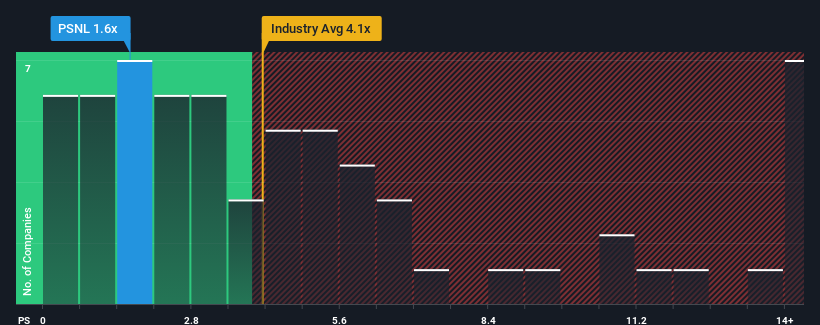

Although its price has surged higher, Personalis may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.6x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 4.1x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Personalis

What Does Personalis' P/S Mean For Shareholders?

Recent times have been pleasing for Personalis as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on Personalis will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on Personalis will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Personalis' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 8.0% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 21% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.7% per year, which is noticeably less attractive.

With this information, we find it odd that Personalis is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Personalis' P/S

Even after such a strong price move, Personalis' P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Personalis currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Personalis (1 is a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Personalis, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.