As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Jiangsu Zhongnan Construction Group Co., Ltd. (SZSE:000961), who have seen the share price tank a massive 85% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And the ride hasn't got any smoother in recent times over the last year, with the price 40% lower in that time. The falls have accelerated recently, with the share price down 19% in the last three months. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since Jiangsu Zhongnan Construction Group has shed CN¥459m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Jiangsu Zhongnan Construction Group

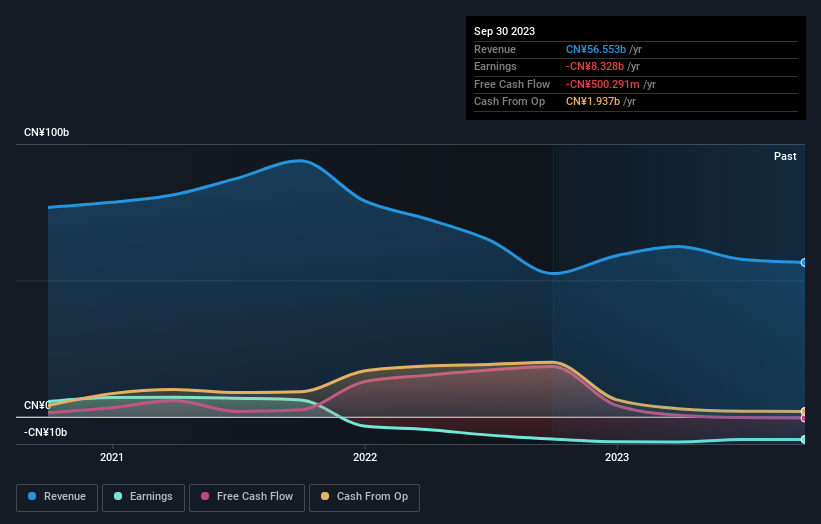

Given that Jiangsu Zhongnan Construction Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Jiangsu Zhongnan Construction Group saw its revenue shrink by 15% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 23%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Jiangsu Zhongnan Construction Group's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Jiangsu Zhongnan Construction Group shareholders are down 40% for the year. Unfortunately, that's worse than the broader market decline of 8.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Jiangsu Zhongnan Construction Group better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Jiangsu Zhongnan Construction Group you should know about.

But note: Jiangsu Zhongnan Construction Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.